The urgency of tackling climate change is no longer a subject of debate; it is an indisputable reality that demands immediate and coordinated global action. Rising GHG Emissions, driven by industrial activity, have propelled temperatures to unprecedented levels, resulting in severe environmental consequences—melting ice caps, erratic weather patterns, and increased frequency of natural disasters. While nations around the world are committing to carbon reduction targets, there is a critical blind spot in global climate efforts: the emissions embedded in internationally traded goods. Imported products often escape the carbon pricing mechanisms imposed on domestic industries, leading to the phenomenon of “carbon leakage,” where production shifts to regions with weaker climate regulations.

To address this gap, the European Union (EU) has introduced the Carbon Border Adjustment Mechanism CBAM Regulations (CBAM)—an innovative policy tool designed to ensure that imported goods bear the same carbon costs as those produced within the EU. CBAM is not just a trade regulation; it represents a transformative approach that bridges environmental goals with economic competitiveness, setting a new benchmark for sustainable global trade. In this blog, we will explore the intricate workings of CBAM, its significance in preventing carbon leakage, its impact on international trade, and the emerging role of specialized platforms like sentra.world in facilitating CBAM reporting and compliance.

In this blog, we will explore:

- What is the Carbon Border Adjustment Mechanism (CBAM)?

- Why is CBAM Needed?

- How Does CBAM Work?

- Phased Implementation of CBAM

- CBAM Regulations and Global Trade: Implications for Exporting Countries

- Challenges and Criticisms of CBAM Regulations

- The Role of sentra.world in CBAM Reporting and Compliance

- The Future of Carbon Border Adjustment Mechanism

- Conclusion

What is the Carbon Border Adjustment Mechanism (CBAM)?

The CBAM is a regulatory mechanism aimed at imposing a carbon price on imports entering the EU market, equivalent to the carbon costs faced by domestic producers under the EU Emissions Trading System (EU ETS). In simpler terms, it ensures that imported goods are subject to the same carbon pricing as goods produced within the EU. The mechanism was introduced to address the issue of “carbon leakage”—a phenomenon where industries relocate their production to countries with less stringent climate policies, thus undermining the EU’s efforts to reduce carbon emissions domestically.

The main goals of CBAM are:

- Preventing Carbon Leakage: By imposing a carbon price on imports, CBAM discourages companies from moving production to countries with lax environmental regulations to avoid carbon costs.

- Promoting Fair Competition: CBAM ensures that EU companies, which are subject to stringent carbon regulations, are not at a disadvantage compared to foreign competitors that do not bear similar carbon costs.

- Encouraging Global Climate Action: By setting an example, the EU hopes that other countries will be incentivized to adopt more ambitious climate policies to avoid facing CBAM tariffs on their exports.

Why is CBAM Needed?

- The Issue of Carbon Leakage: Carbon leakage occurs when companies move their operations to countries with less stringent environmental regulations to avoid the costs associated with complying with climate policies. This undermines the effectiveness of national or regional efforts to combat climate change, as global emissions remain unaffected. Without a mechanism like CBAM, the EU’s climate policies could inadvertently encourage carbon-intensive industries to relocate outside the region, where they could continue to emit GHGs with fewer restrictions.

- Fair Competition in a Global Economy: Countries and companies that take early action on climate change often face higher costs compared to those that delay or avoid taking similar measures. EU industries operating under the EU ETS are required to purchase emissions allowances, which increases their production costs. Without CBAM, foreign companies from countries without carbon pricing would be able to undercut EU companies, leading to unfair competition. CBAM seeks to level the playing field by ensuring that imports face similar carbon costs.

- Aligning Trade with Climate Goals: The EU has set ambitious climate targets, aiming to achieve climate neutrality by 2050. To meet this goal, all sectors of the economy, including trade, need to contribute to reducing emissions. CBAM helps ensure that trade is aligned with these climate goals by incorporating the carbon costs of imported goods into the EU market.

How Does CBAM Work?

Carbon Border Adjustment Mechanism applies to specific carbon-intensive products imported into the EU, such as cement, steel, aluminium, fertilizers, and electricity. It operates in tandem with the EU ETS, ensuring that imports face a similar carbon cost to domestically produced goods. Here’s a step-by-step breakdown of how CBAM works:

- Registration: Importers of goods covered by CBAM must register with national authorities in the EU.

- Emissions Declaration: Importers are required to declare the emissions embedded in their imports based on verified data from producers. For each imported product covered by CBAM, the embedded carbon emissions need to be calculated. This refers to the amount of GHGs emitted during the production of the product in the exporting country. Importers are required to declare the carbon footprint of their goods based on actual emissions data or, if unavailable, default values.

- Carbon Price Adjustment: Once the embedded emissions are determined, the carbon price adjustment is calculated. This is based on the prevailing carbon price in the EU ETS. The importer must then purchase CBAM certificates equivalent to the carbon emissions of the product. The price of these certificates is tied to the EU carbon market, ensuring that imports face the same carbon cost as domestic products.

- Reporting and Verification: To ensure transparency and compliance, importers are required to submit an annual report detailing the carbon footprint of their imports and the corresponding CBAM certificates purchased. This data is subject to verification by independent authorities to ensure accuracy and prevent manipulation.

Phased Implementation of CBAM

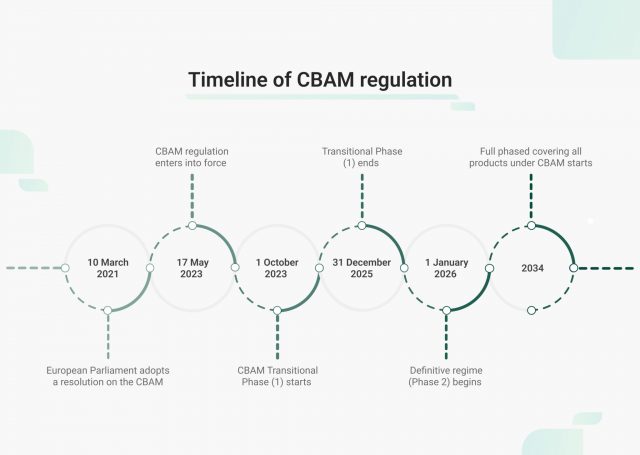

CBAM is not being introduced all at once but is following a phased approach:

- Transitional Phase (2023-2025): During this phase, CBAM will be introduced in a simplified form, focusing primarily on reporting and data collection. Importers will be required to report the carbon footprint of their goods but will not yet be required to purchase CBAM certificates. This phase allows both regulators and importers to adjust to the new system and gather data to refine the mechanism. So, in this phase, Importers must report emissions but do not yet face financial obligations.

- Definitive Phase (Starting 2026): From 2026, CBAM will be fully operational. Importers will be required to purchase CBAM certificates to cover the carbon emissions of their imported goods. The system will be fully integrated with the EU ETS, ensuring that imports face the same carbon pricing as domestic products. However, the mechanism will gradually phase out free allowances under the EU CBAM, increasing financial obligations for importers over time.

CBAM Timeline

CBAM Regulations and Global Trade: Implications for Exporting Countries

Carbon Border Adjustment Mechanism is designed to address climate change on a global scale, but it also has significant implications for international trade. Countries that export carbon-intensive goods to the EU will be directly affected by the mechanism.

- Impact on Developing Countries: Many developing countries rely on the export of carbon-intensive goods, such as steel, cement, and fertilizers, to the EU. CBAM could increase the costs of these exports, making them less competitive in the EU market. However, developing countries with lower-carbon production methods may benefit from CBAM, as it rewards cleaner production processes.

To mitigate the potential negative impacts on developing countries, the EU has proposed providing technical and financial support to help these countries decarbonize their industries and comply with CBAM requirements. - Encouraging Global Climate Action: One of the broader goals of CBAM is to incentivize other countries to adopt more ambitious climate policies. By imposing a carbon price on imports, the EU is sending a signal to the global market that climate considerations will play an increasingly important role in trade. Countries that wish to avoid CBAM tariffs will be incentivized to implement their own carbon pricing mechanisms or adopt cleaner production methods.

Challenges and Criticisms of CBAM Regulations

While Carbon Border Adjustment Mechanism has been hailed as a necessary step to combat carbon leakage and promote global climate action, it is not without its challenges and criticisms.

- Compatibility with WTO Rules: One of the main criticisms of CBAM is that it could lead to trade disputes, particularly with countries that view the mechanism as a protectionist measure. Critics argue that CBAM could violate World Trade Organization (WTO) rules, which prohibit discriminatory treatment between domestic and foreign goods. The EU, however, contends that CBAM is designed to level the playing field and does not discriminate against foreign goods but ensures that they face the same environmental standards as domestic products.

- Complexity of Implementation: CBAM is a complex mechanism that requires accurate data on the carbon footprint of imported goods. For many countries and companies, collecting and verifying this data may be challenging, particularly in sectors where emissions are difficult to quantify. There is also the risk that some companies may attempt to manipulate emissions data to avoid CBAM tariffs. So, we can say that the requirement for detailed emissions reporting and verification can introduce significant administrative burdens for both exporters and EU importers.

- Impact on Consumers: While CBAM is primarily aimed at industries, the costs of the mechanism could eventually be passed on to consumers. Higher import costs for carbon-intensive goods may lead to increased prices for products like steel, cement, and fertilizers, which could affect sectors such as construction and agriculture.

- Carbon Price Volatility: The price of CBAM certificates is tied to the EU ETS, which is known for its price volatility. This could create uncertainty for importers, who may struggle to predict the cost of complying with CBAM. Price fluctuations could also make it difficult for businesses to plan and budget for the future.

The Role of sentra.world in CBAM Reporting and Compliance

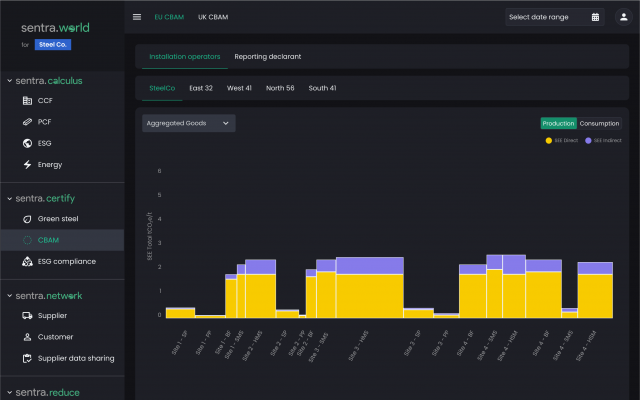

As Carbon Border Adjustment Mechanism becomes a cornerstone of EU climate policy, industries exporting to the EU will need robust tools for compliance and reporting. This is where platforms like sentra.world play a crucial role. sentra.world provides a specialized digital platform designed to help companies navigate the complexities of CBAM reporting, GHG accounting, and carbon compliance. Given the intricate nature of CBAM, which requires precise data on carbon emissions and ongoing verification, sentra.world offers:

- Streamlined Reporting: By integrating emissions data from multiple sources, sentra.world helps importers generate accurate reports on the carbon content of their goods.

- Compliance Assurance: The platform ensures that importers adhere to CBAM by offering automated compliance checks and support for verification processes.

In a rapidly evolving regulatory landscape, tools like sentra.certify and sentra.calculas of sentra.world are indispensable for ensuring smooth compliance with CBAM, helping industries reduce the risk of penalties while promoting greener production practices.

The Future of Carbon Border Adjustment Mechanism

As the EU continues to pursue its ambitious climate goals, Carbon Border Adjustment Mechanism is likely to play a central role in the region’s climate policy. However, the success of the mechanism will depend on how it is implemented and how the global community responds. In the coming years, we can expect to see further refinements to CBAM, including the potential expansion of its scope to cover additional sectors and countries.

There is also the possibility that other regions, such as the United States or India, could adopt similar mechanisms to protect their domestic industries from carbon leakage and promote global climate action. If CBAM proves to be effective, it could serve as a model for other countries and regions looking to align their trade policies with climate goals.

Conclusion

The Carbon Border Adjustment Mechanism represents a watershed moment in global climate policy. By aligning trade with climate goals, CBAM not only addresses carbon leakage but also levels the playing field for industries that have committed to reducing their carbon footprint. The successful implementation of CBAM, however, depends on the cooperation of global industries and the availability of transparent, reliable tools for compliance.

Platforms like sentra.world will be pivotal in this new era of carbon accountability, providing the necessary infrastructure for industries to meet CBAM requirements efficiently and transparently. As we move toward a decarbonized global economy, CBAM offers a template for how environmental objectives and economic interests can converge, driving global action on climate change.

The road ahead is complex, but the stakes have never been higher. CBAM, with its focus on fair competition and global climate action, marks a significant step in ensuring that the future of trade is sustainable and responsible.