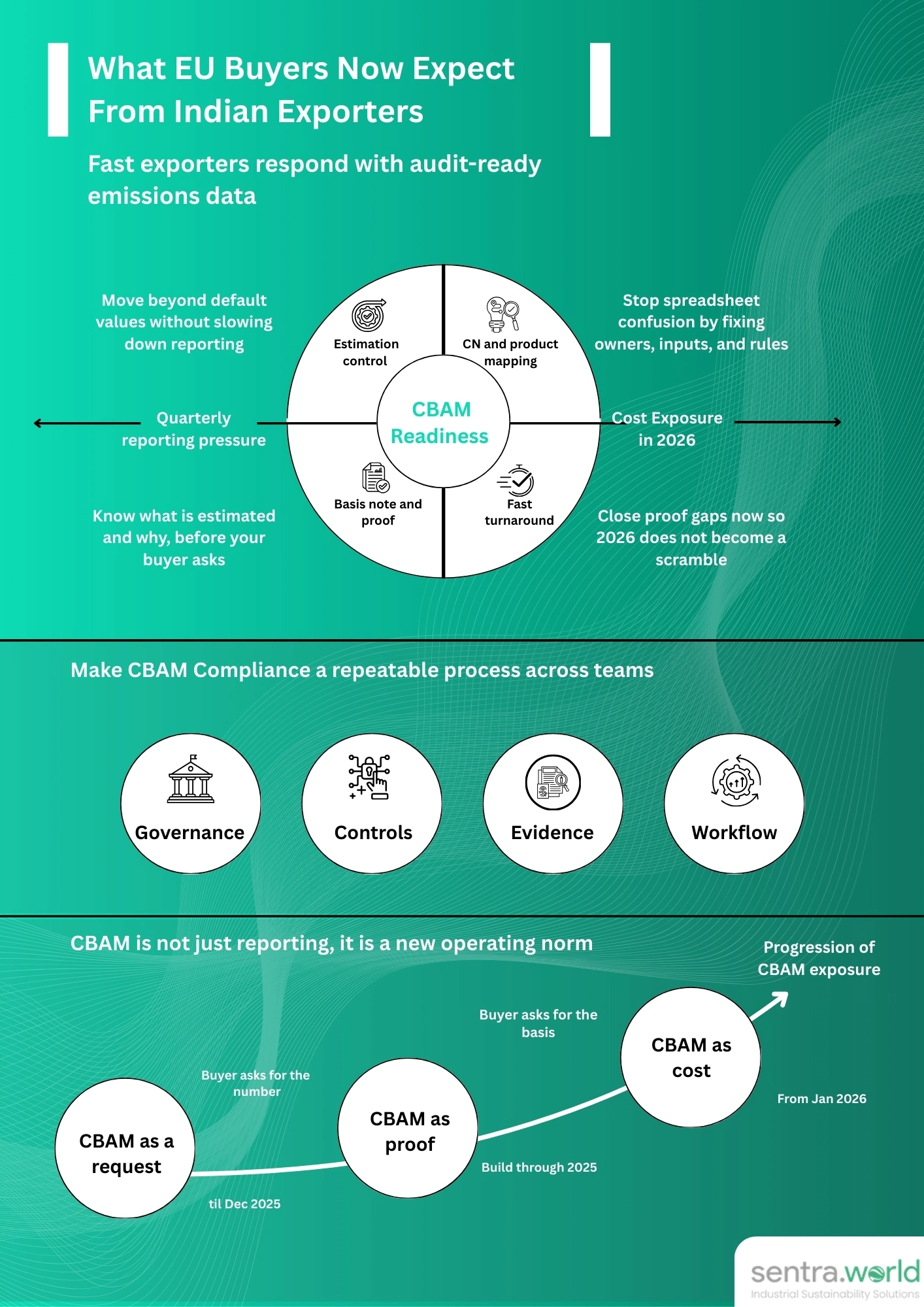

CBAM is not coming as a shock announcement. It is already showing up in day-to-day trade work.

EU buyers are starting to treat emissions data like any other supply requirement. Not as a “nice to have.” As something they need to collect, check, and close every quarter.

If you searched CBAM full form, here it is once: Carbon Border Adjustment Mechanism. But the bigger shift under the EU CBAM regulation is simple: your buyer will ask not only for the emissions number, but also for the basic explanation behind it.

So this blog has one purpose. Help you prepare a “CBAM proof pack” so you can reply with clarity and speed, without last-minute scrambling.

What’s changing in the market

- During the CBAM transitional period (1 Oct 2023 to 31 Dec 2025), reporting was quarterly, and each CBAM report is due within 1 month of the end of each quarter. [Taxation and Customs Union] but it changed when we moved into the definitive phase where the reporting will be annual.

- Default values are no longer seen as a safe shortcut. They are treated as estimates.

- For complex goods, only a limited part of total emissions can come from estimates during the transition window.

- If a report is unclear or incomplete, buyers may come back for revisions, and authorities can also ask for corrections.

- You need to keep supporting records for years, because questions can come later.

This is why CBAM Reporting for Indian exporters feels intense. The EU importer files the report, but they need supplier inputs that are clean and consistent. If your data is messy, you become the delay.

Default values are not wrong, but the Overuse is risky.

In the early phase, default values helped when supplier data was missing. That flexibility has tightened.

For imports from 1 July 2024 to 31 December 2025, default values are counted as estimates, and their use is constrained. For complex goods, up to 20% of total embedded emissions across the production chain may be determined using estimates.

Default values are broad averages. That can hurt in two ways:

- If your real emissions are lower, you can look worse than you are. That can affect buyer preference.

- If your real emissions are higher, the gap does not disappear. It becomes more important when the payment side begins.

Now ask yourself: Do you know where you used default values, and why?

This matters even more in CBAM for the steel, cement, and aluminium sectors, where production is complex. Routes vary. Utilities are shared. Upstream inputs matter. Data sits with different teams. Default values often get used not by choice, but because “we did not have time to gather everything.”

This is exactly where a digital approach becomes necessary. Because CBAM work is now repeated, the same questions are asked every cycle. If your data is spread across spreadsheets, email threads, and different owners, the work moves slowly, and the answers remain inconsistent.

So, the real question is simple: Do you have one place where CBAM data, calculations, and proof sit together?

This is where sentra.world helps without making it complicated. It brings the core CBAM work into one workflow:

- Calculates emissions per CN code using the official method

- Creates the report with a clear summary and annexure format

- Keeps the latest default and benchmark values ready when needed

- Helps you keep documents organised, so audit prep is not a scramble

- Supports portal upload and structured sharing with EU buyers

- Includes aCBAM Liability Calculator so you can quickly see the impact of default values versus your actual data

- Gives carbon cost estimates and a simple forecast view from 2026 to 2034 for planning discussions

This helps reduce rework, confusion, and response time.

But the real problem is the follow-up questions

Most teams can produce a number. The trouble begins when the buyer asks:

“How did you get this?”

The buyer does not want a long report. They want a clear chain they can trust:

- What product was reported, and how was it mapped?

- Which plant route was used?

- What key inputs were used?

- What was real data and what was estimated?

- What simple proof supports the key inputs?

When this chain is weak, small issues create big delays. A unit mismatch. A route assumption. A missing upstream input. Then your team spends days rechecking.

Here is a simple test:

If someone new handled this next quarter, would they reach the same answer?

If not, your buyer will sense the uncertainty.

One small “reporting detail” that causes big confusion

Many reports still get challenged because the explanation is missing.

When estimates are used within the allowed limit for complex goods, Commission guidance instructs reporting declarants to select “Actual data” for certain direct emissions fields in the Transitional Registry, and then explain the estimate use in “Additional Information.”

If you send only the number, without a short basis note, your buyer struggles to defend what they entered. That is how avoidable back-and-forth starts.

So ask this: If your buyer forwards your file inside their company, does your explanation go with it?

The CBAM proof pack that your buyer will start expecting

The simplest way to reduce risk and speed up reporting is to make CBAM work repeatable. Same structure, every quarter.

Here is a clean “proof pack” that works in real life.

1) Route and energy note

Write down the route used and how energy was assigned. Keep it consistent. Update only when reality changes and record the change.

2) Actual vs estimated note

One short paragraph: what is real data, what is estimated, and why. This is what buyers care about.

3) Proof for key inputs

Only for the few inputs that drive the result. Keep those documents easy to retrieve.

This pack does not make CBAM “easy.” It makes it repeatable. That is what buyers value.

Where a CBAM Liability Calculator helps:

Your buyer is not asking for numbers only for compliance. They are also trying to understand the cost impact.

A CBAM Liability Calculator helps you get ahead of that conversation. In simple terms, it helps you:

- See the difference between using default values and using your real data

- Spot which missing inputs increase the outcome the most

- Decide what to fix first, so next quarter is smoother

That is it. Just a tool to reduce surprises and reduce effort.

If you bring in help, a good CBAM consultant, CBAM consultancy, or CBAM consultation should focus on exactly this: making your pack clearer, quicker, and repeatable, without heavy documents.

The outcome to aim for

CBAM is creating a new rule in trade: the number must come with a simple explanation.

So set one clear target for the next quarter: turn days of back-and-forth into one clean response. A number, a short basis note, and a proof pack you can reuse.

If you want to know where to start, start here: take last quarter’s submission and ask, “What part is estimated, and can we explain it in one paragraph?” If not, that is your first fix.

Sentra World built the CBAM Liability Calculator for this exact problem: to help teams see the impact quickly, find the biggest gaps, and reduce the time spent in follow-ups. If you want, we can walk through one product and one plant and show what a clean proof pack looks like in practice.

That is when CBAM compliance stops being a quarterly fire drill and becomes a routine your EU buyers trust, especially for CBAM for Indian exporters in steel, cement, and aluminium supply chains.