The recently concluded COP29 in Baku marked a significant milestone in the global fight against climate change, with the acceptance of a new global carbon market framework. This agreement aims to enhance international cooperation in reducing greenhouse gas emissions and facilitating carbon trading across borders. As nations grapple with the urgent need to address climate change and strive to meet ambitious net-zero targets, understanding the concept of carbon credits and their role in mitigating greenhouse gas emissions has become more important than ever. In this blog, we will unravel the intricacies of carbon credits, starting with their global context, diving into the emerging Indian carbon market, and concluding with insights into how platforms like sentra.world empower industries to navigate this complex landscape.

In this blog, we will explore:

- What are Carbon Credits?

- How Is India Integrating Carbon Trading into Its Climate Strategy?

- What is the Carbon Credit Trading Scheme (CCTS)?

- Which Institutions Are Involved in India’s Carbon Credit Trading Scheme (CCTS)?

- How Can sentra.world Empower Steel Companies in Carbon Credit Trading?

- Conclusion

What are Carbon Markets?

The carbon market operates by enabling the trade of carbon credits, which represent the reduction or removal of one metric ton of CO2 equivalent (CO2e) from the atmosphere. This market is categorized into two types:

- Compliance Carbon Markets: Compliance carbon markets, also known as regulatory carbon markets, are government-mandated systems designed to regulate and reduce greenhouse gas (GHG) emissions. Under this mechanism, governments set specific emission caps for various industries, defining the maximum permissible carbon emissions for companies operating within those industries. To comply, companies must manage their emissions within the allocated limits. If a company exceeds its limit, it must purchase allowances or credits from others who have emitted less than their allotment. This creates a market-driven approach to encourage emission reductions while maintaining economic flexibility.

Globally, the largest compliance markets exist in regions like the European Union, China, Australia, and Canada, where stringent regulations are in place. These markets are expanding, with new initiatives recently launched in India as CCTS, Pakistan, and the UAE. - Project-Based Carbon Markets: Project-based carbon markets operate differently from compliance mechanisms by enabling companies to offset their emissions through investments in specific environmental projects. These projects focus on reducing, avoiding, or removing greenhouse gas (GHG) emissions and provide carbon credits as a reward for their impact.

Credits in project-based markets are issued across eight key project categories:- Renewable Energy: Projects generate clean energy to replace fossil fuels. Over 32% of all voluntary market credits come from renewable energy, primarily grid-connected projects like wind (49%), hydropower (33%), and centralized solar (15%).

- Agriculture: Initiatives include methane reduction in paddy fields and improved irrigation practices. Methane management (78%) and rice emission reduction (17.5%) dominate this category, with the US and China leading credit issuance.

- Transportation: Representing 1% of registered projects, this category focuses on energy-efficient public transportation and EV charging infrastructure.

- Industrial and Commercial: Includes waste heat recovery, energy efficiency, and coal-mine methane capture projects. Major contributors are the US, China, and Germany.

- Chemical Processes: Primarily involves recovering and destroying ozone-depleting substances, with over 90% of projects originating in the US.

- Carbon Capture and Storage (CCS): Focuses on capturing and storing CO₂. While the number of projects is low, this sector is expected to grow due to advancements in carbon capture technologies.

- Waste Management: Projects center on landfill methane flaring or reuse. The US and China host two-thirds of such projects.

- Forestry and Land Use: Emphasizes ecosystem restoration through afforestation, forest management, and wetland restoration. This category generates the highest share of credits, predominantly from the US, Indonesia, Brazil, and Peru. Project-based carbon markets provide flexibility for organizations to meet their climate goals while fostering innovation in environmental sustainability.

The United Nations Clean Development Mechanism (CDM) has been instrumental in the evolution of project-based carbon markets. Established under the Kyoto Protocol, the CDM allows emission-reduction projects in developing countries to earn Certified Emission Reductions (CERs), which can be traded or used by industrialized nations to meet their compliance targets. This mechanism has catalyzed investment in renewable energy, energy efficiency, and sustainable land-use projects, especially in developing regions. By creating a standardized framework for monitoring, reporting, and verification (MRV), the CDM ensured the credibility and environmental integrity of project-based carbon credits. Furthermore, it has supported sustainable development by transferring clean technologies and creating local economic benefits. The CDM’s influence extends to voluntary markets, providing a foundation for project methodologies and credit issuance that continue to drive innovation and trust in carbon offset projects worldwide.

- Voluntary Carbon Markets (VCMs): The Voluntary Carbon Market (VCM) operates differently from compliance-based systems as it is entirely voluntary. In this market, there are no government regulations or mandates forcing companies or individuals to purchase carbon credits or offsets. Instead, participants choose to engage in the VCM because they recognize the value of carbon credits in achieving their sustainability goals, such as becoming carbon neutral. In the VCM, companies, organizations, or even individuals invest in carbon offset projects, such as renewable energy initiatives, reforestation efforts, and methane capture systems, to counterbalance their own emissions. This voluntary approach is driven by a variety of motivations, including corporate social responsibility (CSR), reputational benefits, meeting internal sustainability targets, or responding to consumer demand for environmentally conscious products and services.

What Are Carbon Credits and What Is One Carbon Credit Equal To?

Carbon credits are tradable certificates that represent one metric ton of CO2 emissions or its equivalent in other greenhouse gases. They serve as a mechanism to incentivize reductions in greenhouse gas emissions by allowing companies or countries to buy and sell their emission allowances.

Who can Issues Carbon Credits?

Carbon credits are issued by various entities depending on the type of carbon market—compliance, project-based, or voluntary. In compliance carbon markets, regulatory bodies or government-appointed authorities issue carbon credits to companies that meet their emission reduction targets. For instance, in India’s CCTS (Carbon Credit Trading Scheme), the Bureau of Energy Efficiency (BEE) is responsible for issuing credits under the country’s compliance mechanisms. Similarly, in the European Union’s EU Emissions Trading System (ETS), national authorities of EU member states are the designated issuers. These credits help companies comply with legally mandated emission reduction limits.

In project-based carbon markets, carbon credits are issued for specific environmental projects that reduce, avoid, or sequester greenhouse gas emissions. These projects can be registered with internationally recognized standard-setting bodies, such as the Clean Development Mechanism (CDM) under the UNFCCC, which issues Certified Emission Reductions (CERs). Similarly, projects under the Verified Carbon Standard (VCS) or Gold Standard also generate credits that are verified and issued by these respective organizations, based on rigorous monitoring and validation processes. Examples of such projects include reforestation or renewable energy installations in developing countries, where the credits earned can be traded globally.

In voluntary carbon markets, the issuance of credits is typically managed by certification bodies like the VCS, Gold Standard, and American Carbon Registry (ACR). These bodies verify and issue carbon credits for a wide range of projects, such as forestry, energy efficiency, and methane reduction, based on voluntary participation. Unlike compliance markets, the purchase of credits in the voluntary market is driven by the desire of individuals or companies to offset their carbon footprint and support sustainable practices.

How Is India Integrating Carbon Trading into Its Climate Strategy?

India is emerging as a significant player in the global carbon market with a strong foundation in voluntary, project-based, and compliance carbon trading mechanisms. The country has vast potential, with a carbon market already valued at approximately $1.2 billion (₹9,894 crore) as of 2021. This market is set to expand as climate change pressures intensify and companies work toward net-zero emissions goals.

Voluntary Carbon Market

India’s voluntary carbon market allows businesses, organizations, and individuals to offset their emissions by purchasing carbon credits from environmental projects. The voluntary carbon market in India is thriving, with carbon credits being priced between $2 to $10 (₹165–₹824) per credit. In 2021, global transactions in voluntary carbon markets were valued at $1.98 billion, with the average price of a carbon credit at $4. India’s carbon market has become an important player, valued at $1.2 billion (₹9,894 crore), with developers predicting further growth as climate change urgency increases.

Project-Based Carbon Market and CDM

India has been a global leader in project-based carbon markets, especially under the Clean Development Mechanism (CDM), established by the Kyoto Protocol. Indian industries have the second-largest number of registered CDM projects globally, showcasing their active participation in carbon offset initiatives. These projects involve renewable energy, energy efficiency, and sustainable agriculture, among others, generating significant revenue while reducing emissions. The CDM framework has not only helped Indian industries familiarize themselves with carbon trading but also created a foundation for large-scale project-based market mechanisms.

Compliance Carbon Market: PAT and CCTS

India’s compliance market began with the Perform, Achieve, and Trade (PAT) scheme, launched in 2012 under the National Mission for Enhanced Energy Efficiency (NMEEE). The PAT scheme targeted energy-intensive industries, encouraging them to reduce specific energy consumption. The scheme successfully saved over 106 million tonnes of CO₂ emissions from 2015 to June 2024, generating Energy Saving Certificates (ESCerts) as tradable assets for industries exceeding their energy efficiency targets.

Building on this success, India is transitioning to a more comprehensive compliance carbon market under the Carbon Credit Trading Scheme (CCTS). Managed by the Bureau of Energy Efficiency (BEE), the CCTS will incorporate learnings from the PAT scheme and other compliance instruments to create a unified domestic carbon market. This shift aims to align India’s market with global standards while supporting its climate commitments.

NOW lets deep dive into CCTS carbon credit trading scheme

What is the Carbon Credit Trading Scheme (CCTS)?

The Carbon Credit Trading Scheme (CCTS) is a regulatory framework initiated by the Government of India to facilitate the reduction of greenhouse gas emissions through a market-based approach. It allows obligated entities to trade carbon credits, incentivizing them to lower their emissions and meet national climate goals.

What are the key objectives of the CCTS?

The primary objectives of the CCTS include:

- Mobilizing Mitigation Opportunities: Creating demand for emission reduction credits through both private and public entities.

- Establishing a National Framework: Providing a structured approach to reduce, remove, or avoid greenhouse gas emissions in India.

- Pricing Emission Reductions: Enabling trading of carbon credit certificates to assign a monetary value to emission reductions.

What are the Compliance and Offset Mechanisms Under India’s Carbon Credit Trading Scheme (CCTS)?

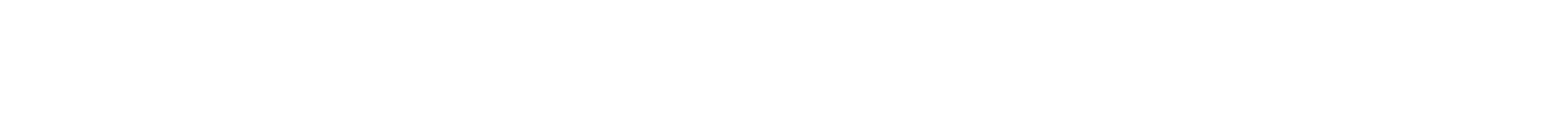

The Carbon Credit Trading Scheme (CCTS) introduces two distinct mechanisms to drive decarbonisation:

- Compliance Mechanism: This is a mandatory program for energy-intensive industries, where the government sets greenhouse gas (GHG) emission intensity targets (measured as emissions per unit of output). Registered entities identified as “obligated entities” must comply with these targets.

The Bureau of Energy Efficiency (BEE) identifies sectors with GHG reduction potential and recommends inclusion in the Indian carbon market. It also suggests sector-specific emission intensity targets (in tCO₂e per unit of output) after evaluating technological feasibility and implementation costs. Based on these recommendations, the Ministry of Power finalizes the targets and forwards them to the Ministry of Environment, Forest, and Climate Change for notification under the Environment Protection Act, 1986. Entities achieving emission levels below their targets receive Carbon Credit Certificates (CCCs), while those failing must surrender or purchase certificates to cover their shortfall. The existing Perform, Achieve, and Trade (PAT) scheme will transition gradually into the CCTS, starting with nine sectors: Aluminum, Chlor-Alkali, Cement, Fertilizer, Iron & Steel, Pulp & Paper, Petrochemicals, Petroleum Refinery, and Textiles, with more sectors to follow.

- Offset Mechanism: This is a voluntary, project-based mechanism enabling non-obligated entities to reduce, remove, or avoid GHG emissions. Projects registered under this mechanism will be eligible for CCCs upon meeting the eligibility criteria outlined by the BEE, based on recommendations from the National Steering Committee for Indian Carbon Market (NSCICM). The offset mechanism provides opportunities to mitigate emissions from sectors outside the compliance framework, incentivizing actions in diverse areas. Projects will undergo a structured lifecycle, from registration to approval, before earning CCCs.Proposed sectors for phased inclusion in the offset mechanism are:

- Phase I: Energy, Industries, Agriculture, Waste Handling and Disposal, Forestry, and Transport.

- Phase II: Fugitive Emissions, Construction, Solvent Use, and Carbon Capture and Storage (CCS).This dual approach allows India to cover both obligated and non-obligated sectors, maximizing its decarbonisation potential while supporting sustainable development.

How are greenhouse gas (GHG) emission intensity targets determined?

The GHG emission intensity targets are determined by:

- The MoEFCC, based on recommendations from the Ministry of Power.

- Assessments considering available technologies and likely costs associated with their implementation.

- The National Steering Committee for Indian Carbon Market (NSC-ICM) provides governance and oversight for establishing these targets.

What is a compliance year?

A compliance year refers to a specific financial year in which obligated entities must meet their assigned GHG emission intensity targets. These targets are set before the commencement of each trajectory period, which typically spans three consecutive compliance years.

What happens if an obligated entity exceeds its GHG emission intensity target?

If an obligated entity exceeds its target, it is entitled to receive Carbon Credit Certificates (CCC). The number of CCCs issued is based on the difference between the achieved GHG emission intensity and the target intensity, multiplied by production units for that year.

What must an obligated entity do if it fails to meet its GHG emission intensity target?

An obligated entity that fails to meet its target must surrender a number of CCCs equivalent to its shortfall. If it does not have enough CCCs, it must purchase additional credits from the market.

How is the number of CCCs calculated for surrendering?

The required number of CCCs for surrendering is calculated by taking the difference between actual and target GHG emission intensities and multiplying it by production for that year. This ensures that entities account for their emissions accurately.

What is meant by “banking” of Carbon Credit Certificates?

Banking refers to the ability of obligated entities to save their unused CCCs for future compliance years or trade them later. This provides flexibility in managing carbon credit portfolios and helps companies plan their emissions strategies over time.

Which Institutions Are Involved in India’s Carbon Credit Trading Scheme (CCTS)?

The Carbon Credit Trading Scheme (CCTS) involves multiple institutions working collaboratively to establish and manage the Indian Carbon Market (ICM). These institutions include:

- National Steering Committee for Indian Carbon Market (NSCICM): The NSCICM is the apex body overseeing the ICM’s functioning. Chaired by the Secretary of the Ministry of Power and co-chaired by the Secretary of the Ministry of Environment, Forest, and Climate Change, it includes members from various ministries and organizations. Its responsibilities include recommending rules, regulations, and procedures for the carbon market to the Bureau of Energy Efficiency (BEE), setting emission targets, monitoring market operations, and guiding international carbon credit trading and certificate issuance.

- Bureau of Energy Efficiency (BEE): The BEE serves as the scheme’s administrator, identifying sectors with emission reduction potential, setting targets for obligated entities, accrediting verification agencies, and issuing carbon credit certificates upon approval. It also manages market stability mechanisms, develops data systems, conducts capacity-building activities, and maintains secure databases and IT platforms for market operations.

- Grid Controller of India (GCI): The GCI operates the ICM registry, enabling the registration of entities, maintaining accounts of issued carbon credits, facilitating trading transactions, and serving as a meta-registry with secure data management protocols.

- Central Electricity Regulatory Commission (CERC): CERC regulates trading activities within the carbon market by approving power exchange regulations, maintaining market oversight, and taking corrective actions to ensure trust and prevent fraud in trading operations.

- Accredited Carbon Verification Agency (ACVA): The ACVAs are responsible for validation and verification activities within the carbon market. The BEE accredits these agencies based on defined eligibility criteria and procedures.This institutional framework ensures transparency, credibility, and efficient functioning of India’s carbon market, supporting its transition to a low-carbon economy.

How Can sentra.world Empower Steel Companies in Carbon Credit Trading?

Steel manufacturing is among the most carbon-intensive industries, significantly contributing to global greenhouse gas (GHG) emissions. With increasing regulatory requirements and stakeholder demand for sustainable practices, steel companies must adopt innovative strategies to reduce their carbon footprint and leverage opportunities in carbon credit trading.

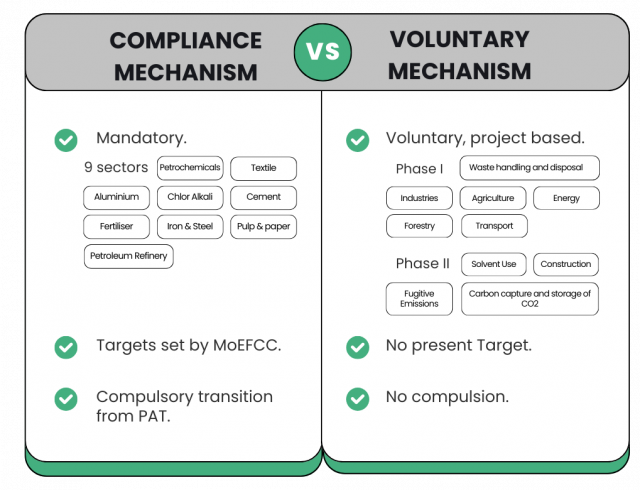

A SaaS platform like sentra.world offers tailored solutions to help steel manufacturers navigate carbon markets efficiently. Here’s how it supports the industry:

- GHG Measurement: sentra.world provides advanced methodologies to measure emissions across Scope 1, Scope 2, and Scope 3. Accurate data ensures credible carbon credits and compliance with global standards.

- Automated Compliance Reporting: The platform simplifies regulatory reporting through automated workflows, reducing administrative burdens while ensuring accurate and timely submissions.

- GHG & Operations Tracking Dashboard: sentra.world’s real-time dashboard tracks emissions and operational metrics, helping companies identify inefficiencies, monitor progress, and make informed decisions.

- Net-Zero Pathway Planning: By modeling budgets and assessing the financial and environmental impacts of interventions, sentra.world enables steel companies to create actionable strategies for achieving net-zero emissions, aligning with their long-term sustainability goals.

Conclusion

The global carbon market, strengthened by frameworks like the one ratified at COP29, is pivotal in addressing climate change. Carbon credits serve as an essential tool for reducing greenhouse gas emissions and fostering sustainable practices. With India’s forthcoming compliance carbon market in 2025, the stage is set for industries to align with global standards and contribute to national climate goals.

Steel, one of the most carbon-intensive industries, has an opportunity to lead this transition. By adopting innovative strategies and leveraging platforms like sentra.world, companies can achieve significant emission reductions, enhance operational efficiency, and unlock new revenue streams through carbon credit trading. sentra.world empowers steel companies with tools for precise emission measurement, compliance reporting, and strategic planning, enabling them to navigate the complexities of the carbon market effectively. As regulatory pressures mount and climate goals become more ambitious, the role of carbon markets in driving sustainable growth cannot be overstated. By integrating advanced solutions and fostering collaboration, we can ensure a low-carbon future while supporting economic development worldwide.