In recent times, the issue of climate change and reducing carbon emissions has become a top priority for many countries and industries around the world. One of the proposed solutions to address this urgent problem is the implementation of a Carbon Border Adjustment Mechanism (CBAM). This mechanism is particularly relevant for energy-intensive industries like iron and steel, which are also known to be significant contributors to global carbon emissions. In this blog, we will explore about CBAM for steel industry and how calculation will be carried out. Apart from this, we will analyse how CBAM is impacting the iron and steel sector, and how a young sustainability startup sentra.world helping iron and steel sector to overcome with the impact.

Table of Contents:

- Understanding CBAM

- CBAM for Steel Sector industry: A key player in carbon emissions

- CBAM Calculation for the Iron and Steel Industry

- CBAM Reporting

- How Does CBAM Impact the Iron and Steel Industries?

- Benefits of CBAM for the Iron and Steel Industries

- Conclusion

Understanding CBAM

The Carbon Border Adjustment Mechanism (CBAM) is a regulatory mechanism designed to levy a carbon price on imported goods, ensuring that products entering the EU face equivalent carbon costs to those produced domestically within the EU. This mechanism aims to prevent carbon leakage, where companies relocate production to countries with less stringent environmental regulations to avoid carbon costs. By applying a carbon price to imports, Carbon Border Adjustment Mechanism seeks to create a level playing field for EU producers who already bear these costs through the EU Emissions Trading System (ETS).

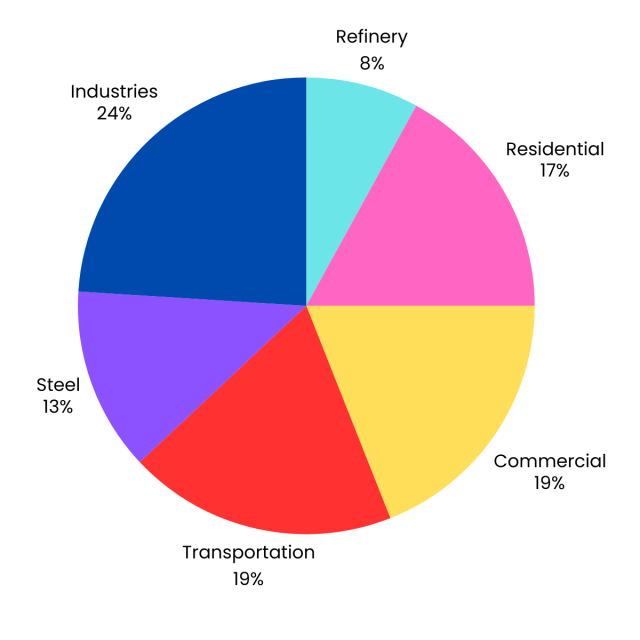

The Carbon Border Adjustment Mechanism specifically targets high-emission sectors, including cement, iron and steel, electricity, aluminium and fertilizers. As of October 2023, importers of these goods are required to report their embedded emissions and purchase CBAM certificates corresponding to those emissions.

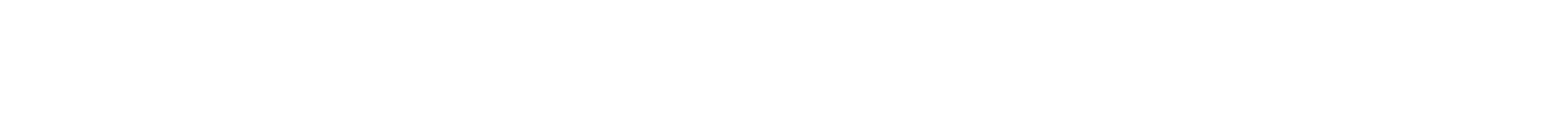

CBAM for Steel Industry: A Key Player in Carbon Emissions

The steel sector is one of the most energy-intensive industries globally and a significant contributor to carbon emissions due to its reliance on carbon-intensive processes like the traditional blast furnace route. The steel industry is a significant contributor to global carbon emissions, accounting for approximately 13% of all CO2 emissions and 7-9% of total greenhouse gases. With annual emissions averaging around 3.7 billion tonnes, countries strive to meet ambitious emission reduction targets. Hence, the steel industry has come under scrutiny for its environmental impact, necessitating the adoption of cleaner and more sustainable production practices. So, for the iron and steel sector, Carbon Border Adjustment Mechanism addresses the issue of carbon emissions embedded in imported products of iron, steel, and ferroalloys (Key Products: Rolled steel, hot/cold-rolled coil, steel bars, iron ore, etc). By imposing a carbon cost on imports, it levels the playing field for EU manufacturers who are already subject to carbon pricing under the EU Emissions Trading System (ETS). To streamline compliance, Carbon Border Adjustment Mechanism has provided a list of CN codes for the products covered under the regulation. We’re sharing the link here so you can check whether your product is covered or not in the regulation (CN code).

CBAM Calculation for the Iron and Steel Industry

Carbon Border Adjustment Mechanism applies to both direct and indirect emissions. Direct emissions refer to greenhouse gases (GHG) produced during the actual manufacturing process, such as those released during the reduction of iron ore in blast furnaces. Indirect emissions arise from the energy consumed during the manufacturing process, typically from the electricity used in steel production. CBAM direct emissions align with GHG Protocol Scope 1, while indirect emissions relate to Scope 2. The embedded emissions of precursors and broader value chain emissions would fall under Scope 3.

During the transitional phase, importers are required to report both direct and indirect emissions for all goods within CBAM’s scope. However, in the definitive phase beginning on 1 January 2026, the Carbon Border Adjustment Mechanism scope will focus on direct emissions for sectors like aluminium and iron/steel, etc. Importers of cement and fertilizers, however, will continue to report both direct and indirect emissions beyond this point.

Carbon Border Adjustment Mechanism requires accurate reporting of Direct and Indirect emissions and for that actual data on embedded emissions from specific goods at the installation level is preferred. If it is not possible then default emission factors can be used. CBAM has also given timeline on how we should use default emission factors values and it says:

- During the first three quarterly reports (Q4 2023 and Q1 & Q2 2024), importers can report embedded emissions using default values without any quantitative limits.

- From Q3 2024 until the end of 2025, the use of default values is limited to 20% of total embedded emissions for complex goods. This means that while default values can still be used, they cannot exceed this percentage of total emissions reported.

So, the default emission factors serve as a temporary measure to facilitate compliance with Carbon Border Adjustment Mechanism reporting obligations during its transitional phase, allowing importers to estimate embedded emissions when actual data is unavailable. However, as the mechanism evolves, reliance on these factors will decrease in favour of more accurate reporting based on actual emissions data.

CBAM Reporting

- The Carbon Border Adjustment Mechanism has provided a Communication Template is an essential Excel tool developed by the European Commission to streamline the reporting of embedded emissions for goods subject to the Carbon Border Adjustment Mechanism (CBAM). Its primary purpose is to facilitate the exchange of standardized emissions data between producers outside the EU and importers, ensuring consistency and accuracy in reporting. By organizing complex emissions data into a structured format, the template simplifies compliance with CBAM requirements for both producers and importers.

- Initial Reporting (Transitional Period): From October 2023 to December 2025, Carbon Border Adjustment Mechanism for steel industry will be implemented in a transitional phase. During this period, companies exporting to the EU will be required to report the emissions embedded in their products without paying the associated carbon price. This data collection phase is crucial for companies to prepare for full compliance after 2025.

- Full CBAM Implementation: Once CBAM is fully operational post-2025, importers will need to purchase Carbon Border Adjustment Mechanism certificates corresponding to the embedded emissions of their iron and steel products. The price of these certificates will mirror the EU ETS price. To ease the burden on importers, allowances for free allocation will gradually phase out under the ETS, so companies will need to buy certificates for all the carbon content of their imports.

How Does CBAM Impact the Iron and Steel Industries?

The implications of CBAM for the iron and steel industries are profound, as outlined below;

- Increased Costs: The requirement to purchase carbon certificates can significantly raise operational costs for non-EU steel producers.

- Trade Dynamics: The introduction of CBAM may alter global trade patterns. Countries like India and China, which currently export substantial volumes of steel to the EU, may find their competitiveness diminished as they face higher costs compared to EU producers. This could lead to a shift in sourcing strategies for EU manufacturers.

- Administrative Burden: Compliance with CBAM requires extensive monitoring and reporting of emissions. This adds complexity and can strain resources within companies, particularly smaller firms that may not have the infrastructure in place for such detailed tracking.

- Data Collection: Reliable data on emissions from non-EU producers is required, which could be a challenge in regions with less stringent reporting practices.

Benefits of CBAM for the Iron and Steel Industries

While CBAM presents challenges, it also offers opportunities.

- Reduction in Carbon Emissions

By imposing a carbon price on imports, CBAM encourages foreign producers to reduce their carbon footprint to remain competitive in the global market. This would compel steel manufacturers to explore cleaner and more sustainable methods of production to meet the criteria for carbon pricing, ultimately leading to a reduction in carbon emissions from the iron and steel industries globally.

- Level Playing Field

CBAM helps to level the playing field between domestic and foreign producers by ensuring that all steel products in the market bear the true cost of their carbon emissions. This can prevent carbon leakage, which occurs when production is shifted to regions with lower environmental standards and promote fair competition between domestic and foreign steel producers.

- Incentivizes Innovation

The implementation of CBAM can incentivize innovation in the iron and steel industries. Manufacturers may be motivated to invest in cleaner and more sustainable production technologies to minimize their carbon footprint and maintain competitiveness in the market. This shift towards innovative and sustainable practices could ultimately benefit the environment and contribute to a more sustainable steel industry.

- Supports Climate Goals

By reducing carbon emissions and promoting sustainable practices in the iron and steel industries, CBAM plays a crucial role in supporting global climate goals. As countries strive to meet their climate targets outlined in international agreements such as the Paris Agreement, the implementation of CBAM can be a driving force in aligning the iron and steel industries with these ambitious objectives.

However, CBAM is placing significant pressure on developing nations like India, Brazil, and South Africa by imposing carbon costs on exports to the EU, despite these countries contributing far less to historical global emissions compared to developed nations. While these economies are still in the process of industrialization, CBAM effectively raises the cost of their goods, pushing them to adopt expensive low-carbon technologies without addressing the EU’s own historical responsibility for a large share of global emissions. This creates a disparity, as developing nations argue for a fairer approach that considers their developmental needs and past emissions imbalances.

Conclusion

In conclusion, we can say that the introduction of the Carbon Border Adjustment Mechanism (CBAM) marks a transformative moment for the iron and steel industries. As one of the most carbon-intensive sectors, the iron and steel industry is under significant pressure to decarbonize and comply with strict emissions reporting regulations. CBAM aims to create a level playing field by imposing a carbon price on imports based on their embedded emissions, ensuring that foreign producers face the same carbon costs as EU-based companies. This shift is expected to drive the industry toward cleaner production methods, energy efficiency improvements, and increased use of renewable energy.

However, the transition presents challenges, particularly in tracking and reporting emissions accurately across complex supply chains. Companies must ensure they have the necessary infrastructure in place to measure both direct and indirect emissions, which will directly impact their compliance with Carbon Border Adjustment Mechanism.

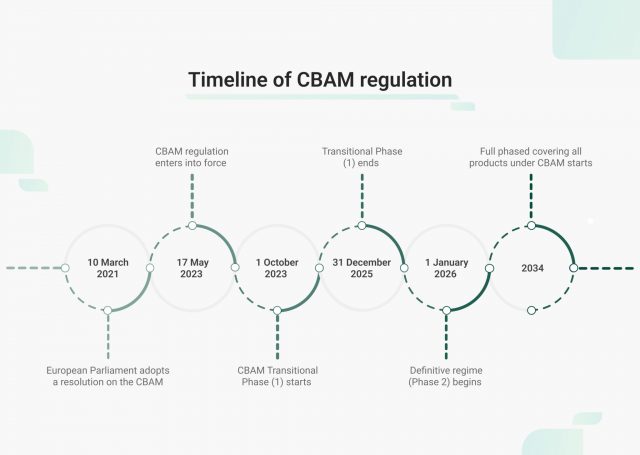

This is where sentra.world can offer critical support, by playing a pivotal role in this transition by offering advanced tools sentra.certify and expertise to help companies accurately calculate and report their emissions in compliance with CBAM. We offer a comprehensive solution for CBAM compliance through its cutting-edge software, designed to streamline reporting and provide in-depth analytics. One of the key features is Automated Report Creation, allowing businesses to generate accurate and compliant CBAM reports with minimal manual effort, ensuring timely submissions and reducing the risk of errors. sentra.world also provides an Instant Updates of Regulation to their client, and also updates their system with the latest CBAM regulations and requirements, helping companies stay compliant with evolving rules. All these features empower businesses to make informed decisions, assess carbon liabilities, and improve overall sustainability strategies under CBAM regulations.

Ultimately, the success of Carbon Border Adjustment Mechanism will depend on strong collaboration between industries, regulators, and governments to create a sustainable and equitable future. However, Carbon Border Adjustment Mechanism must also take into account the unique challenges faced by developing countries, such as limited access to clean technologies and financial constraints. By incorporating mechanisms that support these countries, CBAM can drive global decarbonisation more effectively, ensuring no region is left behind in the shift toward a low-carbon economy and a more sustainable future for all.