Continuing from our previous discussion on the Indian Carbon Credit Trading Scheme (CCTS), this blog delves into the calculation methodology integral to the scheme. It encompasses the scope boundaries, notional emissions, targets, and compliance cycles, as well as the methods for raw material and fuel data collection and reporting. Grasping these elements is essential for stakeholders to effectively navigate the compliance landscape.

First, let’s recap the key highlights from our last blog:

India introduced Carbon Credit Trading Scheme (CCTS), represents a landmark initiative aligned with its Paris Agreement commitments to reduce GHG emissions intensity by 45% by 2030 compared to 2005 levels. The scheme aims to establish a robust domestic carbon market, incentivizing emission reductions through two mechanisms:

- Compliance Mechanism – Targeting obligated entities in energy-intensive sectors with mandatory emission reduction requirements.

- Offset Mechanism – Encouraging voluntary GHG reduction projects from non-obligated entities.

The Energy Conservation (Amendment) Act, 2022, empowers the Indian government to establish a domestic carbon market and authorize designated agencies to issue CCCs, each representing one tonne of CO₂ equivalent reduction or removal from the atmosphere. The Ministry of Power oversees the regulatory framework of the CCTS, with the Bureau of Energy Efficiency (BEE) acting as the designated administrator.

The BEE released a draft of the regulations in November 2023 and refined them following an extensive stakeholder consultation process. In July 2024, the Indian government adopted detailed regulations for the planned compliance carbon market under the CCTS. These regulations outline key design elements of the compliance mechanism, marking a significant advancement in India’s emerging carbon pricing framework.

Now, let’s delve deeper into the specifics of the compliance mechanism and calculation methodology that underpin the scheme.

In this blog, we will explore:

- CCTS Calculation Methodology

- GHG Emission Reporting and Pro Forma

- Carbon Credit Certification and Compliance

- Conclusion

CCTS Calculation Methodology

The calculation methodology under CCTS is designed to ensure that greenhouse gas (GHG) emissions are accurately measured, reported, and verified. This process involves several key components:

- Scope Boundaries: The GHG emissions assessment is confined to the Gate-to-Gate boundary, which includes:

- Direct Emissions: These are emissions that occur from production processes within an entity’s operational control. It includes:

- Process Emissions: Emissions resulting from chemical reactions during production.

- Combustion Emissions: Emissions from burning fuels for energy.

- Indirect GHG Emissions: These are emissions associated with the consumption of purchased electricity and heat used in production processes.

- Notional Emissions: To ensure consistency across sectors, notional emissions may be added for raw materials or intermediate products imported within the entity’s boundary.

- Direct Emissions: These are emissions that occur from production processes within an entity’s operational control. It includes:

- Greenhouse Gases (GHG) coverage: The compliance mechanism under CCTS currently covers greenhouse gases such as carbon dioxide (CO₂) and perfluorocarbon (PFC) gases emitted from the operations of obligated entities. These emissions are quantified in terms of carbon dioxide equivalent (CO₂e) by applying the Global Warming Potential (GWP) values for the respective gases, as specified in the latest assessment report by the IPCC. The GWP values for various greenhouse gases are detailed in CCTS compliance mechanism document released by BEE. Additionally, other greenhouse gases may be included under the mechanism in the future.

- Monitoring of Activity Data: Obligated entities are required to monitor activity data from source streams through direct measurement at the emission source or by aggregating quantities delivered or consumed, considering relevant stock changes. The latter method involves calculating activity data as the total fuel or material received during the compliance year, minus the quantity moved out, plus the opening stock, minus the closing stock. Quantities are expressed in mass (tonnes), volume (kilolitres or cubic meters), and, where direct measurement is infeasible, estimation methods can be employed. These include referencing previous year data correlated with current-year output or using audited financial statements, with adequate documentation retained for verification.

- Measuring Energy Content and Emission Factors: Obligated entities are required to determine and apply greenhouse gas (GHG) emission factors either as default values (Type I) or site-specific values (Type II) derived from the processes, analysis of fuels or materials. Type I emission factors, also known as standard emission factors, should be used only when Type II factors are unavailable. These default values can be sourced from the latest national inventory submissions, such as the Biennial Update Report or National Communication by the Government of India to the UNFCCC, or from standard emission factors published by statutory organizations, central government bodies, or reputed international organizations. The selection of Type I factors must adhere to the principle of conservativeness and be based on the type of fuel used.

On the other hand, Type II emission factors, which are site-specific, are preferred for calculating emissions from solid and gaseous fuels and process emissions. These factors are derived using laboratory analysis of fuels and raw materials, specifically by calculating the site-specific Net Calorific Value (NCV) and Total Carbon (TC) percentage in the fuel. For solid fuels, this involves solid fuel analysis, while for gaseous fuels, it requires composition analysis. In cases where the contribution of liquid or gaseous fuels to overall emissions is less than 10% within the Gate-to-Gate boundary of the entity, emissions may be estimated using actual NCV values and Type I factors. Any discrepancies in the selection of emission factors are resolved by the Bureau, based on recommendations from technical committees. - Things not to be included in calculation: When calculating greenhouse gas (GHG) emissions, several sources are excluded to ensure clarity and alignment with established guidelines. These exclusions include emissions from biomass or biogenic energy sources and renewable energy. Additionally, emissions from co-processing alternate fuels, such as hazardous waste or other wastes, are excluded, provided these fuels are recommended by technical committees and approved by the National Steering Committee for Indian Carbon Market (NSC-ICM). However, fuels like petroleum coke, carbon black, petro polymer fuel, peat, and dolochar do not qualify as alternate fuels.

Energy consumption in attached colonies, temporary or large-scale construction work, and external transportation is excluded, as these do not directly result from production processes. Emissions from refrigerant leakages in office buildings and processes are similarly omitted. Furthermore, emissions from captive energy production that are exported outside the entity’s operational boundary are not considered. Lastly, any additional sources or streams recommended by the technical committee and approved by NSC-ICM are also excluded from the calculation.

To ensure transparency and accuracy in assessing greenhouse gas emissions, the methodology for calculation must seamlessly transition into a robust framework for monitoring and reporting, enabling consistent evaluation and compliance with regulatory standards.

GHG Emission Reporting and Pro Forma

The Bureau of Energy Efficiency (BEE) has introduced a streamlined and standardized approach to monitoring and reporting GHG emissions. A central component of this system is the GHG Emission Calculation Pro Forma, a standardized template provided by BEE. Designed as an Excel-based or IT-based system, this template enables obligated entities to systematically calculate and report their greenhouse gas emissions, ensuring consistency and transparency across the compliance process.

Submission of GHG Emission Reports

Within four months of the compliance year’s conclusion, obligated entities are required to submit their GHG Emissions Report and the duly verified GHG Emission Pro Forma. Verification must be conducted by an accredited carbon verification agency, and submissions are to be made to the Bureau of Energy Efficiency (BEE) and the respective State Designated Agency (SDA).

Key Components of the GHG Emission Report

The following details should be included in the annual report:

- Entity Identification and Contact Details

- Registration number assigned to the obligated entity.

- Information about the Plant Head and Energy Manager, including their names, addresses, and contact details.

- Reporting Year Information

- Clear identification of the reporting year for which the emissions data is presented.

- Monitoring Plan Reference

- Details of the latest monitoring plan, including its version number and effective date.

- Operational Changes

- Disclosure of any significant changes in operations during the reporting period.

- Production and Process Details

- Data on raw material consumption and production processes, including sub-processes.

- Emissions Source and Data

- Comprehensive details for all emissions sources, including:

- Total emissions in tonnes of CO2 equivalent.

- Non-CO2 GHG emissions in metric tonnes.

- The calculation methodologies applied.

- Emission factors used and activity data, such as fuel quantities (in tonnes or Nm³) and net calorific values (in kCal/kg or kCal/Nm³).

- Mass Balance Methodology data to compare the carbon content of streams entering and exiting the entity.

- Comprehensive details for all emissions sources, including:

- Sampling and Data Management

- Detailed sampling plans and data control measures.

- Biomass Usage

- Memo items documenting biomass amounts combusted or employed in processes, expressed in TJ, tonnes, or Nm³.

- GHG Reduction Measures

- A summary of greenhouse gas reduction measures implemented during the reporting year.

By incorporating the GHG Emission Calculation Pro Forma, the reporting framework ensures precision and consistency in data collection, offering entities a robust tool to manage compliance while contributing to sustainability goals. This structured approach is complemented by a well-defined system of forms and reporting requirements, which guide entities through the compliance process while maintaining transparency and accountability.

Forms and Reporting

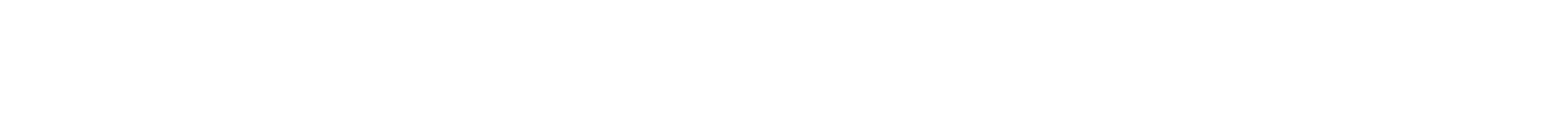

- Forms to Be Submitted:

- Reporting Timeline:

- Monitoring plans must be submitted within three months of the compliance year.

- Verified GHG emissions reports are due within four months of the compliance year.

After all the activities undertaken by the obligated entity under this procedure shall be scrutinised by the accredited carbon verification agency for the purpose of preparation of verification report and verification of compliance with respect to GHG emissions intensity targets as notified by the MoEFCC.

Carbon Credit Certification and Compliance

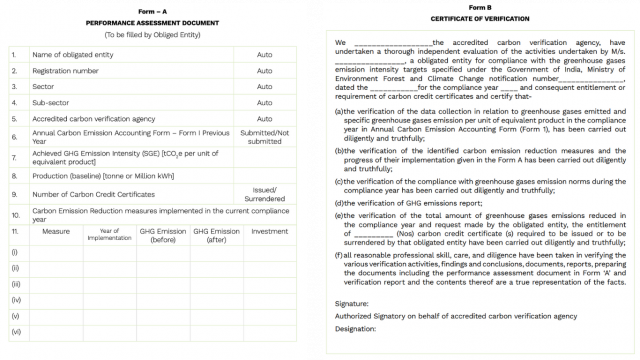

The issuance and management of carbon credit certificates play a pivotal role in ensuring compliance with greenhouse gas (GHG) emission intensity targets under the National Steering Committee for Indian Carbon Market (NSC-ICM). The process begins with the verification of reports and concludes with the issuance or surrender of carbon credits on the ICM Registry, fostering accountability and incentivizing sustainable practices.

Verification and Submission to NSC-ICM

Once the Bureau of Energy Efficiency (BEE) verifies the accuracy of the obligated entity’s claims made in Form ‘A’, including any additional check verification reports when necessary, it submits the final report to the NSC-ICM. This submission must be completed within two months following the final deadline for Form ‘A’ submission. The primary objective is to facilitate the issuance of carbon credit certificates under Section 14AA of the Act.

The verification report includes:

- Carbon Credit Entitlement

- The exact number of carbon credit certificates to be issued, determined by the formula: Number of certificates (tCO₂e)=(GEI Target−GEI Achieved)×Quantity of Equivalent Product Produced.

- Confirmation of the entity’s entitlement to purchase these certificates.

- Certification of Compliance

- Verification by an accredited carbon verification agency confirming that the entity meets all requirements for issuance.

The NSC-ICM reviews the report and recommends issuance within two weeks of receiving it. The Bureau then issues the carbon credit certificates on the ICM Registry within two weeks of the recommendation.

Surrender of Carbon Credit Certificates

For entities required to surrender carbon credits to comply with GHG emission intensity targets, the verification report specifies:

- Surrender Requirements

- The exact number of certificates to be surrendered, calculated using the formula: Number of certificates to be surrendered (tCO₂e)=(GEI Achieved−GEI Target) × Quantity of Equivalent Product Produced.

- Certification of Compliance

- Verification confirming that the entity has complied with all requirements for surrender.

- Verification confirming that the entity has complied with all requirements for surrender.

- Registry Adjustment

- The Bureau debits the entity’s registry account with the equivalent number of surrendered carbon credit certificates, ensuring compliance with GHG intensity targets.

This structured approach promotes transparency, standardization, and accountability, aligning the carbon credit system with India’s broader sustainability and climate action goals.

Conclusion

The Indian Carbon Credit Trading Scheme (CCTS) exemplifies a well-structured and meticulously designed framework to address climate change challenges. At the heart of its effectiveness lies a robust calculation methodology that ensures precision, transparency, and accountability in monitoring greenhouse gas emissions.

From defining scope boundaries to incorporating notional emissions, the system captures the nuances of industrial emissions across diverse sectors. The compliance mechanism, with its clear trajectory periods, targets, and rigorous data collection protocols, reinforces the scheme’s credibility. By mandating stringent reporting and verification through accredited agencies, the CCTS creates a trustworthy foundation for emission reductions and carbon trading.

This robust calculation system not only bolsters confidence among stakeholders but also establishes a benchmark for emerging carbon markets globally. As industries embrace the CCTS, it promises to drive innovation, foster sustainable practices, and position India as a leader in climate action.

At sentra.world, we are dedicated to empowering businesses to meet their CCTS compliance requirements with ease and precision. Our expertise in GHG accounting, emissions reporting, and regulatory compliance ensures that organizations can confidently navigate the complexities of the scheme. From data collection and monitoring to customized reporting solutions, we provide end-to-end support for seamless integration with the CCTS framework.

Thank you for reading, and stay tuned for our next blog, where we explore the trading mechanisms and opportunities within the Indian Carbon Market. Together, let’s advance toward a sustainable and carbon-neutral future with sentra.world by your side.