Reducing carbon emissions is no longer just a regulatory requirement; it’s an urgent necessity. In India, 60% of emissions come from industrial manufacturing, with 15% stemming from the metals value chain, including mining, steel and aluminium production, casting forging, and foundry industries. India is the 2nd largest foundry industry with over 10 million tonnes of production. India’s CO2 emissions stand at 2.5t CO2e/t crude steel, compared to the global average of 1.9, making it one of the highest emitters globally. As CBAM regulations come into play, decarbonisation becomes even more critical for India’s metals industry, where foundries are key players.

In this blog, we will explore:

- What is CBAM?

- How foundry companies win in the CBAM age?

- About sentra.world

- How can sentra.world help?

What is CBAM?

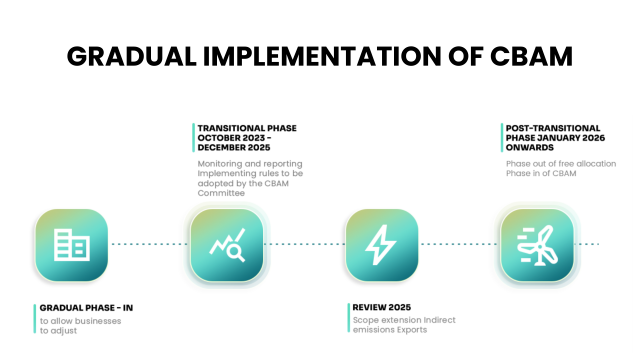

The Carbon Border Adjustment Mechanism (CBAM), introduced by the European Union, is a groundbreaking initiative designed to combat climate change with the aim of reducing carbon emissions. This regulation puts a carbon price on imports from countries with less stringent environmental regulations to avoid the risk of ‘carbon leakage’.

CBAM will first target imports of specific goods and selected materials with high carbon emissions, prioritizing sectors like Cement, Iron & Steel, Aluminium, Fertilizers, Electricity, and Hydrogen.

These sectors collectively account for more than 45% of CO2 emissions in EU ETS sectors when fully phased in. India exports $8bn+ worth of metal products which now comes under the CBAM regulation.

How foundry companies win in the CBAM age?

In the CBAM era, foundry companies can succeed by first measuring their CO2 emissions, as effective management starts with accurate measurement. Understanding recognized methodologies is key. Here’s how the CBAM methodology works:

- Quarterly reporting: The documents need to be sent from operators of installations (exporters) to reporting entities (importers), who then upload data into the EU transition registry by the end of the month for the previous quarter. CBAM reporting entails structured data submission using provided XSD and ZIP files for accurate and timely reporting, ensuring comprehensive emission assessment and compliance.

- CN Codes: The classification of goods under CBAM is determined using Combined Nomenclature (CN) codes. These codes categorize goods and help identify which imports are subject to the carbon adjustment mechanism. These codes are not arbitrary; they are internationally recognized and can be found in official documents provided by the European Union, such as the CBAM Transitional Registry User Manual.

- Direct & Indirect Emissions: Direct emissions originate from industrial processes, while indirect emissions arise from the consumption of electricity, heat, or steam generated from external sources. Indirect consumption also includes embedded emissions of purchased raw materials. This comprehensive approach ensures that all relevant carbon emissions are accounted for, providing a complete picture of the carbon footprint of imported goods. Both direct and indirect emissions are crucial to report accurately for CBAM compliance.

- Mass Balance-based Calculation: The mass balance calculation method involves determining the carbon – content in fuels and input materials, identifying the carbon content in all output materials, and then calculating the difference between inputs and outputs. This approach ensures accurate measurement of carbon emissions by tracking the flow of materials within the production system, maintaining consistency and accuracy in reporting.

- Outputs as Annex IV and Summary Communications: Detailed reports of emissions, known as Annex IV reports, must be submitted. These reports provide comprehensive data on the emissions embedded in imported goods.

Templates provided by the EU, including an Excel spreadsheet and Annexure 4 document, facilitate reporting. Emissions are to be verified by an EU-accredited verifier post-2026. - Reduce Emissions to Reduce Taxes Starting in 2026: From 2026 onwards, companies can lower their tax liabilities under CBAM by reducing their carbon emissions, incentivizing the adoption of greener practices and low-carbon technologies for gaining a competitive edge.

Additionally, they must procure CBAM certificates to offset emissions beyond permissible levels, establishing a carbon price and aiming to achieve zero emissions by 2034.

About sentra.world

At sentra.world, we’re not just a company; we’re a movement. We’re revolutionizing the way people connect with sustainability and technology. As a B2B SaaS carbon accounting software firm, we specialize in helping industrial businesses measure, report, and reduce their carbon emissions. Our services include GHG accounting, ESG reporting, CBAM compliance, and more. With expertise in industrial manufacturing, our team of 35+ professionals based in Bengaluru works with clients across India, North America, the Middle East, and beyond. Join us in our mission to create a greener, smarter planet!

How can sentra.world help?

- Carbon Tracking and Reporting: Using digital tools for carbon management helps track and report emissions accurately, crucial for CBAM compliance. At sentra.world, we focus on ESG and decarbonization across scope 1,2 and 3, offering a software platform like sentra.calculus powered by Al and blockchain.

- Engagement with Suppliers: Collaboration with suppliers to reduce product footprints is key to mitigating emissions throughout the supply chain via sentra.network. Foundry companies must actively engage with suppliers to align strategies and achieve emission reduction targets collectively.

- Footprint Verification and Regulatory Compliance: Following international standards and best practices is vital. sentra.certify can ensure compliance while offering a competitive edge in the market.

- Assessment of Climate-related Risks and Opportunities: Conducting assessments of climate-related risks and opportunities allows companies to anticipate the impact of CBAM on their operations. sentra.reduce helps companies set their net zero roadmap, conduct techno commercial decision making, identify and execute decarbonisation projects. This enables informed decision-making and proactive measures to mitigate risks and capitalize on opportunities in the CBAM age.Its critical for foundry companies to start thinking about and implementing strategies to address CBAM requirements now. By proactively managing emissions, ensuring regulatory compliance, and fostering collaboration throughout the supply chain, foundries can position themselves for success in the evolving regulatory landscape.

To know more about the Economic Impact of the Carbon Border Adjustment Mechanism, GHG check out our other blogs.