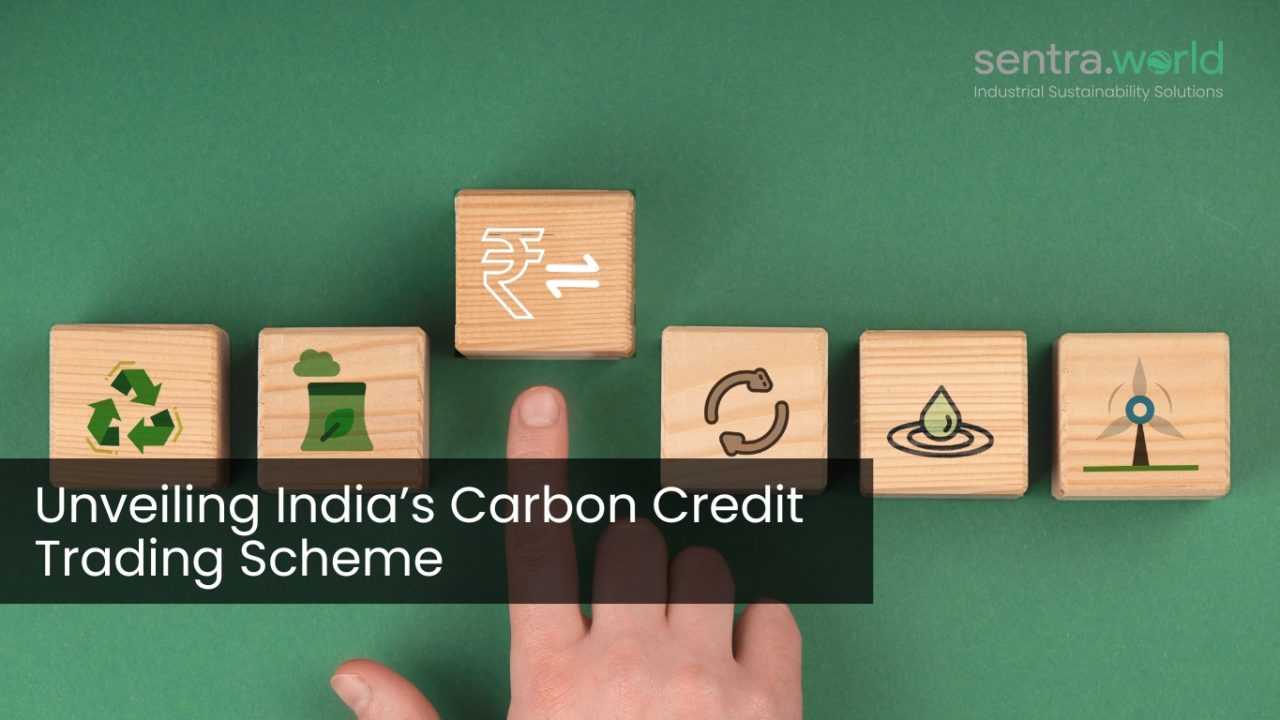

As the world grapples with the urgent need to address climate change, countries are searching for innovative solutions to reduce carbon emissions and transition to a greener future. Recently, in a landmark moment for global climate governance, COP29 delivered on a decade-long promise by launching the world’s first unified global carbon market under the Article 6 of the Paris Agreement. This decision, made during the climate summit in Baku, Azerbaijan, establishes operational standards for a global carbon market, enabling countries and companies to trade emission reduction credits effectively. This landmark decision aims to enhance cooperation among nations in reducing greenhouse gas emissions, allowing countries to trade carbon credits as a means of achieving their climate goals. The acceptance of this framework reflects a growing recognition of the importance of market-based mechanisms in addressing climate change and fostering sustainable development.

As the world embraces this new era of carbon trading, India is poised to play a pivotal role in the global carbon market. With its ambitious targets under the Paris Agreement and a robust domestic Carbon Credit Trading Scheme (CCTS) spearheaded by the Bureau of Energy Efficiency (BEE), India is not only aligning itself with global standards but also setting an example for other developing nations. The Indian government has committed to reducing its greenhouse gas emissions intensity by 45% by 2030 compared to 2005 levels, demonstrating its dedication to combating climate change while promoting economic growth.

India’s CCTS is designed to facilitate compliance and voluntary actions across various sectors, creating a comprehensive approach to decarbonisation. By integrating with the global carbon market established at COP 29, India can leverage international partnerships and investments, enhancing its capacity to meet its climate commitments. This synergy between global initiatives and national strategies positions India as a key player in the fight against climate change, paving the way for a sustainable future. With this backdrop, we will delve deeper into the intricacies of India’s CCTS, exploring its regulatory framework, compliance mechanisms, and the optimistic outlook for a greener future.

In this blog, we will explore:

- Understanding Carbon Pricing Instruments: The Key to Decoding CCTS Type

- What is Carbon Credit Trading Scheme (CCTS) in India

- Regulatory Bodies and its Responsibilities

- Optimistic Outlook: Benefits Beyond Emission Reductions

- Challenges Ahead: Navigating Implementation

- India’s Potential as a Leader in Carbon Credit Trading

- Conclusion: Embracing a Sustainable and Prosperous Future

Understanding Carbon Pricing Instruments: The Key to Decoding CCTS

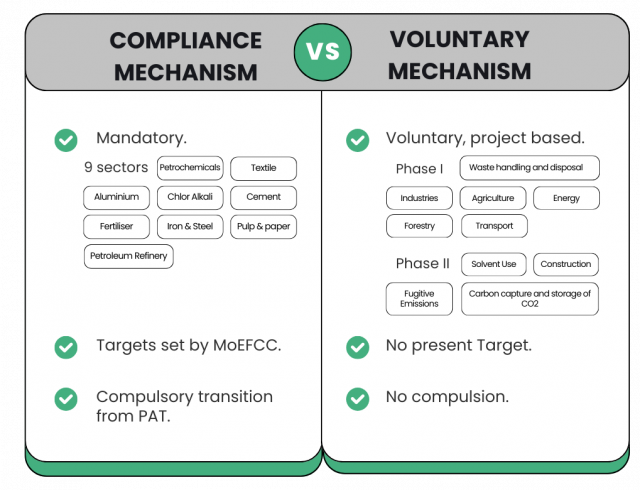

Carbon pricing plays a crucial role in addressing the global challenge of climate change. It can be categorized into two main types: compliance mechanisms and voluntary mechanisms. Compliance mechanisms, such as Emissions Trading Systems (ETS), are government-mandated frameworks that set emission caps and allow entities to trade allowances. Conversely, voluntary mechanisms enable organizations to offset their emissions by purchasing carbon credits from projects that reduce or remove GHG emissions.

India has experience with both compliance and voluntary markets. The Perform Achieve and Trade (PAT) scheme has successfully reduced over 106 million tonnes of CO2 emissions since its inception in 2015. This familiarity with market-based mechanisms positions India well for the implementation of a comprehensive domestic carbon market framework.

What is Carbon Credit Trading Scheme (CCTS) in India

Indian CCTS operates on the principle of emissions reduction and offsetting. Businesses that successfully reduce their carbon emissions below a certain threshold are eligible to earn carbon credits. These credits can then be traded on the carbon market, allowing businesses to financially benefit from their climate-friendly actions.

The process begins with businesses measuring and quantifying their carbon emissions. This data is verified by independent auditors to ensure accuracy and transparency. Once the emissions are calculated, businesses can identify areas for improvement and implement strategies to reduce their carbon footprint.

If a business exceeds its emissions reduction targets, it can generate excess carbon credits. These credits can be sold to other businesses that require additional allowances to comply with emissions regulations. By purchasing the carbon credits, these businesses can offset their own emissions and meet their sustainability goals. Carbon credit trading not only incentivizes emissions reduction but also promotes the development of sustainable projects. For instance, businesses can invest in renewable energy projects, such as wind farms or solar power plants, to generate additional carbon credits. This encourages the growth of the clean energy sector and facilitates the transition to a low-carbon economy. On similar lines Indian CCTS has two mechanisms:

- Compliance Mechanism: Driving Emission Reductions

The compliance mechanism targets energy-intensive industries by setting GHG emission intensity targets. Obligated entities must comply with these targets or purchase carbon credits if they fall short. This approach encourages industries to innovate and adopt cleaner technologies while providing flexibility in meeting their obligations. The transition from the PAT scheme to CCTS will enhance opportunities for decarbonisation across nine key sectors:- Iron & Steel

- Aluminium

- Chlor Alkali

- Cement

- Fertilizer

- Pulp & Paper

- Petrochemicals

- Petroleum Refinery

- Textile

As more sectors are included in the future, this mechanism will play a critical role in reducing India’s overall emissions footprint. For more details, you can explore the document provided by BEE through the provided link (compliance mechanism).

- Offset Mechanism: Encouraging Voluntary Actions

The offset mechanism enables non-obligated entities to register projects focused on reducing or preventing GHG emissions. By fulfilling eligibility requirements set by the BEE, these projects can earn carbon credit certificates. This voluntary approach incentivizes actions in sectors not covered under compliance mechanisms, fostering innovation and participation across various industries. Sectors such as agriculture, forestry, and waste management are included, with plans to expand into emerging areas like carbon capture and storage. The Bureau of Energy Efficiency (BEE) has recently published a comprehensive document outlining the approved sectors, sub-sectors, and associated technologies under the Offset Mechanism of the Carbon Credit Trading Scheme (CCTS). For more details, you can explore the document provided by BEE through the provided link (Sectors in Offset Mechanism under CCTS).

Regulatory Bodies and its Responsibilities

To ensure the effective implementation and governance of India’s CCTS, a multi-tiered institutional and regulatory framework has been established. This structure brings together key stakeholders across government ministries, regulatory bodies, and technical agencies, each with clearly defined roles to facilitate the smooth functioning of the Indian Carbon Market (ICM).

- Regulatory Framework

The Energy Conservation (Amendment) Act, 2022, empowers the Central Government to specify a carbon trading scheme, facilitating the issuance of carbon credit certificates representing one ton of CO2 equivalent reduction. This regulatory framework is vital for establishing a transparent and efficient trading environment. - Institutional Framework

- The National Steering Committee for Indian Carbon Market (NSCICM): Policy Architects At the apex of the framework is the National Steering Committee for Indian Carbon Market (NSCICM). Chaired by the Secretary of the Ministry of Power and co-chaired by the Secretary of the Ministry of Environment, Forest, and Climate Change, this committee includes representatives from various ministries and relevant organizations. The NSCICM plays a pivotal role in shaping the Indian Carbon Market. Its responsibilities include:

- Guiding the Development of the ICM Framework: Recommending to the Bureau of Energy Efficiency (BEE) procedures to institutionalize the Indian carbon market, ensuring robust and transparent processes.

- Establishing Market Rules and Regulations: Recommending the formulation and finalization of rules governing the functioning of the carbon market.

- Setting GHG Emission Targets: Proposing specific greenhouse gas emission intensity targets for obligated entities to align with national climate goals.

- Promoting International Engagement: Advising on guidelines for trading carbon credit certificates beyond India’s borders, integrating the domestic market with global carbon trading networks.

- Overseeing Market Operations: Monitoring the functioning of the Indian Carbon Market to ensure its effectiveness and reliability.

- Issuing Carbon Credit Certificates: Supporting the issuance and management of carbon credit certificates.

- Advisory Role: Recommending the creation of committees or working groups to address emerging challenges and opportunities within the carbon market.Through these responsibilities, the NSCICM ensures that the Indian Carbon Market evolves in alignment with global best practices while catering to local needs.

- Bureau of Energy Efficiency (BEE): The Scheme Administrator

As the central administrator of the CCTS, the Bureau of Energy Efficiency (BEE) ensures the operationalization of the compliance and offset mechanisms. Its key functions include:- Sector Identification: Pinpointing sectors with significant GHG reduction potential and recommending their inclusion in the carbon market.

- Target Development: Designing emission intensity trajectories and reduction targets for obligated entities.

- Carbon Credit Certificate Management: Issuing carbon credit certificates based on the recommendations of NSCICM and central government approvals.

- Market Stability: Developing mechanisms to stabilize the carbon market and prevent volatility.

- Accreditation Oversight: Establishing accreditation procedures for agencies responsible for verifying GHG emission reductions.

- Fee Determination: Setting fees for registered entities to cover implementation costs, with central government approval.

- Capacity Building: Conducting stakeholder training and awareness programs to enhance participation and understanding.

- Digital Infrastructure Development: Creating and maintaining IT systems, including user-friendly platforms, secure databases, and data submission formats.The BEE serves as the linchpin, ensuring that all elements of the CCTS operate seamlessly and contribute to achieving India’s climate targets.

- Grid Controller of India (GCI): Registry Operator

The Grid Controller of India (GCI) acts as the registry operator for the ICM, tasked with maintaining transparency and accountability in carbon credit management. Its functions include:- Entity Registration: Facilitating the registration of participants in the Indian Carbon Market.

- Account Management: Maintaining accurate records of carbon credits issued to entities.

- Transaction Facilitation: Enabling smooth transactions of carbon credits on the designated platform.

- Meta Registry Functionality: Maintain secure database with all security protocols as approved by NSC-ICM.

- Central Electricity Regulatory Commission (CERC): Market Regulator

The Central Electricity Regulatory Commission (CERC) ensures the integrity and fairness of trading activities within the ICM. Its key responsibilities include:- Regulatory Approvals: Sanctioning the business regulations of power exchanges for carbon credit trading.

- Market Oversight: Monitoring market activities to identify and mitigate fraud or mistrust.

- Corrective Actions: Implementing measures to maintain trust and stability in the trading ecosystem.

- Accredited Carbon Verification Agencies (ACVA): Guardians of Integrity

Validation and verification of emission reductions are carried out by Accredited Carbon Verification Agencies (ACVA). These agencies, accredited by the BEE, ensure the accuracy and credibility of GHG emission reports and reductions. Key responsibilities include:- Verifying compliance with GHG emission intensity targets.

- Conducting independent assessments of carbon reduction claims.

- Preparing verification reports to support the issuance or surrender of carbon credit certificates.This comprehensive institutional framework not only supports compliance and voluntary mechanisms but also fosters transparency and accountability within the carbon trading system.

As India embarks on this ambitious journey towards a sustainable future, it faces both challenges and opportunities in carbon credit trading. In the next section, we will explore these challenges and opportunities, examining how they can shape the effectiveness of carbon credit trading in India.

Optimistic Outlook: Benefits Beyond Emission Reductions

The benefits of CCTS extend far beyond mere emission reductions, presenting India with a unique opportunity to enhance its economic landscape, such as:

- Economic growth and investment opportunities: CCTS will incentivize cleaner technologies and practices which potentially results into investment in renewable energy projects and implementing sustainability practices, businesses can create employment opportunities in the clean energy sector. This not only contributes to reducing unemployment rates but also supports the development of new skills and expertise. Additionally, carbon credit trading can attract foreign investment. As the world becomes increasingly focused on combating climate change, investors are seeking opportunities in green markets. India, with its vast potential for renewable energy and carbon reduction projects, can position itself as an attractive investment destination. This influx of foreign capital can spur economic growth and help finance essential infrastructure for sustainable development.

- Global Leadership: By establishing a robust carbon market, India can position itself as a leader in climate action on the global stage.

- Enhanced Reputation: Companies participating in carbon trading can enhance their corporate social responsibility profiles, appealing to environmentally conscious consumers.

- Energy Security: By participating in carbon credit trading, India can improve its energy security. By diversifying its energy mix and reducing reliance on fossil fuels, India can become less vulnerable to volatile global oil prices. This can lead to more stable and predictable energy costs, benefiting both businesses and consumers.In conclusion, carbon credit trading holds immense potential for India’s economy. Not only can it address environmental challenges and contribute to sustainability goals, but it can also create job opportunities, attract foreign investment, enhance energy security, improve international reputation, and foster innovation. As we continue to explore the promise of carbon credit trading in India, we will delve deeper into challenges that lie ahead.

Challenges Ahead: Navigating Implementation

The journey towards implementing India’s Carbon Credit Trading Scheme (CCTS) is fraught with challenges that must be navigated carefully to ensure its success. Some of the primary challenges are:

- Raising awareness and building capacity: Ensuring that all stakeholders understand the carbon trading process is crucial for successful participation. Many industries especially small and medium enterprises (SMEs) may lack a comprehensive understanding of carbon trading mechanisms, which could hinder their participation. To address this, government would require a targeted capacity-building initiatives in partnership with sustainability startups like sentra.world, as it is essential to educate businesses about the benefits and operational aspects of carbon trading, as well as the processes involved in registering for carbon credits.

- Establishing effective international linkages: As India seeks to integrate its domestic carbon market with global systems, it must navigate the complexities of aligning its regulatory framework with international standards. This involves ensuring that Indian carbon credits are recognized and accepted in foreign markets, which requires bilateral and multilateral negotiations with countries that have their own carbon trading systems. Additionally, India needs to develop the technical capacity for monitoring, reporting, and verification (MRV) processes that meet global benchmarks. Balancing these international commitments with domestic economic interests is crucial, as participation in global carbon markets could impact local industries. Addressing these challenges effectively will enable India to leverage Global unified carbon market accepted in COP29 Baku and enhance its role in the global fight against climate change.

India’s Potential as a Leader in Carbon Credit Trading

As we continue our exploration of carbon credit trading and its immense potential to create a greener future, it is important to acknowledge India’s unique position in this landscape. India, with its rapidly growing economy and commitment to sustainable development, has the opportunity to become a global leader in carbon credit trading. With a diverse range of industries, including renewable energy, manufacturing, and transportation, India has ample scope to reduce its carbon emissions and generate carbon credits. By embracing CCTS, Indian businesses can not only contribute to global climate goals but also create new avenues for economic growth.

India’s renewable energy sector, in particular, holds immense promise in this regard. With its ambitious renewable energy targets and significant investment in solar and wind power, India is well-positioned to harness its clean energy potential and leverage it in the carbon credit trading market.

Moreover, by successfully implementing in CCTS, India can attract foreign investment, foster technological advancements, and create employment opportunities. This can propel India’s transition to a low-carbon economy and position the country as a frontrunner in the global fight against climate change and showcase its leadership in sustainability.

Conclusion: Embracing a Sustainable and Prosperous Future

As we come to the end of this blog series on CCTS in India, it is clear that there is immense potential for businesses to shape a greener future. Through their active participation in CCTS, they have the power to drive sustainable practices and reduce carbon emissions. Along with this, CCTS is a testament to the country’s commitment to a sustainable future. By integrating compliance and voluntary mechanisms, fostering innovation, and promoting market-based solutions, the CCTS paves the way for a low-carbon economy. It is a bold step, one that holds immense promise for India and the world in the fight against climate change.

So, let us continue to embrace the power of carbon credit trading and work together towards a sustainable and prosperous future. As Each of us has the ability to make a difference, and together, we can build a society that thrives on sustainable practices, innovation, and environmental preservation.

Thank you for joining us on this journey. Stay tuned for more insightful content on sustainable living and renewable energy solutions. Together, we have the power to shape a brighter future for ourselves and the generations to come.