What’s New at a Glance?

- Calculation Methodology: There is no change since last 6 months

- Default Emission Factors: No change since December 2023 release

- Threshold values (required to calculate carbon tax): Expected to release in the coming few weeks before the CBAM regime starting January 2026

- Tax Regime: Starts 1 January 2026

- Audit for 2026: Independent verification is required. (Schedule to be decided and the list of the auditors to be published)

- Issuance of Carbon Certificates: Certificate obligations begin January 2026; importers are required to purchase CBAM certificate quarterly. Issuance and first surrender for 2026 imports may start in February 2027 within EU’s centralized CBAM registry handled by national competent authorities.

The European Union has recently confirmed that Carbon Border Adjustment Mechanism (CBAM) benchmarks for exporters in other countries for CBAM calculation of import related carbon costs in energy heavy industries like steel, aluminum, cement, fertilizers will be out in the market in the coming few weeks and finalized until Q1 2026. The reference values for 2026-2030 of EU ETS (Emissions Trading System) will align with these CBAM benchmarks and will be there for reference.

Along with this new improvement, the EU is also adopting Omnibus I regulation which plans to simplify administrative and compliance burdens on the companies especially SMEs but also does not compromise the initial thought of CBAM’s ambition on climate change.

In this blog, we will talk about:

Table of Contents

Overview of how CBAM calculations are done

The carbon cost of the goods is calculated by taking in account the emission intensity (tCO₂ per unit of product) values as the CBAM benchmarks. To prevent carbon leakage, an ETS-based methodology was introduced that ensures consistent calculation and treatment between EU production and imports. Importers need to start preparing compliance systems for final benchmark implementations, but till then importers can model exposure using the ETS value until the official benchmarks for CBAM are published in the coming few weeks.

EU CBAM 2025: Key Updates in CBAM regulations

1. De Minimis Threshold

- If the imports of an importer are ≤50 tonnes per year then they will be exempt from reporting and certifications obligations for their carbon emissions. This new threshold will be effective from 1 January 2026.

- This new threshold exempts ~90% of importers which mainly includes SMEs and individuals who are importing CBAM like steel, aluminum and more in small quantities.

- With this new threshold, the climate ambition for CBAM is still in play as ~99% of CO2 emissions coming from major industries like iron, steel, aluminum, cement and fertilizers are still covered under it.

- Scope 3 emissions such as hydrogen and electricity calculations are fully calculated and are not eligible for exemption in this threshold.

What this means for the exporters is while the smaller EU buyers are currently exempt from detailed reporting, most of the trade volume and emissions will require verified data for embedded emissions. As a result of this, it will make CBAM registration and transparency and reporting critical to ensure and maintain CBAM readiness.

2. Registration Flexibility

- The trading will not be hindered for the importers while they wait for registration approval, but only if applications are submitted before 31 March 2026.

- CBAM declarations can be delegated to third parties with valid EORI registration by authorised declarants even during the procedural transitions.

3. Streamlined Reporting & Verification

The revised rules introduce simplified processes for data collection, verification and carbon calculations.

- Default values can be used for emissions without independent verification, but actual emission values require verification.

- To promote transparency and reduce administration ambiguity, adjustments to penalties and custom representation rules have been made.

4. Compliance Coverage

- As we already know, 90% of importers are exempted within the new threshold, but the climate ambitions remaining intact by ~99% of embedded emissions in CBAM-covered goods remain in scope.

- Additionally, the free ETS allowances will gradually phase out starting from 2026 and will be completely gone by 2034, which results in increasing CBAM exposure.

If the exporters want to remain preferred, verifiable partners for EU buyers need to register early and maintain transparent data as CBAM enforcement tightens post 2026.

Simplify your CBAM compliance with sentra.world’s automated software to experience seamless integration, efficient calculations and verified emissions tracking.

Timeline & Critical Milestones

- From 1st January 2026, the definitive CBAM regime starts and temporary exemptions that were discussed earlier will apply.

- The final CBAM benchmarks will be published by the European Commission in the coming few weeks before the Q1 of the 2026 enforcement phase.

- The CBAM certificates will be priced based on quarterly ETS averages and the annual declarations are due on 30th September 2027.

- Then gradually during the period of 2026-2034, there will be a gradual reduction of free ETS allocation and an increase in Carbon Border Adjustment Mechanism exposure.

Recommended Actions for Exporters for the transition phase of 2025-2026

- Model the carbon cost of the goods

The exporters can anticipate and estimate the carbon cost of exported goods using the provisional EU ETS benchmarks while preparing yourself for the transition to the official CBAM values once published in the coming weeks.

- Strengthen Data Collection Systems and leverage digital platforms like sentra.world

To meet EU buyers’ growing demand of transparency, the exporters must ensure that the emission intensity data must align with Carbon Border Adjustment Mechanism reporting templates and must be independently validated. Using AI digital platforms such as sentra.worldto automate the process of emission data collection, validation, carbon liability calculation and to meet the standards of Carbon Border Adjustment Mechanism and ETS which will ensure seamless compliance and effective transition during the period.

- Supporting Buyers in Compliance

The exporters can help their authorised declarants by providing all the verified data in the required Carbon Border Adjustment Mechanism formats. By providing this, the importers can submit the reports quickly and position you as a preferred supplier in the market.

- Register and Integrate Systems Early

Encourage your authorized partners to apply for the status before the march of 2026 and to start the integration of your data into their Carbon Border Adjustment Mechanism declaration systems as well.

How sentra.world helps you with CBAM compliance?

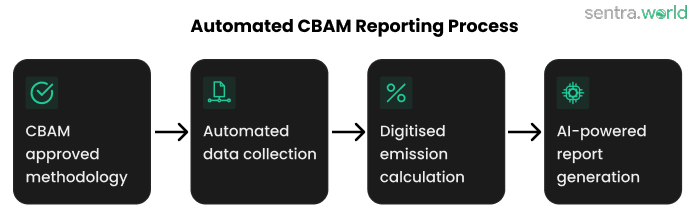

At sentra.world,we help you simplify the Carbon Border Adjustment Mechanism reporting process for exporters and EU importers through our digital platform solution which is designed for accuracy and efficiency through all processes and CBAM consultancy support.

We enable exporters to seamlessly align with EU Carbon Border Adjustment Mechanism compliance and standards by:

- Gathering, validating, and reporting the emissions data at the product level in accordance with Carbon Border Adjustment Mechanism and ETS procedures.

- Utilizing verified emission intensity metrics (tCO₂/unit) to ensure transparency that is audit ready.

- Streamlining filing and verification of EU authorized declarants (importers) by delivering AI-driven Carbon Border Adjustment Mechanism reports.

We empower exporters to stay competitive and transparent in the changing EU market by making the Carbon Border Adjustment Mechanism compliance process effortless and efficient for you.

Stay tuned for more insights and updates on Carbon Border Adjustment Mechanism– its process, regulations and also the implementation of roadmap and timeline to be kept in mind.

Are you ready to simplify your Carbon Border Adjustment Mechanism reporting journey?

Book your Demo Now and let us help automate your carbon reporting seamlessly.

Learn more about us at: https://sentra.world