A buyer in the EU is reviewing your next shipment. The discussion is going well. Price is fine. Lead time is fine.

Then one message lands that changes the tone:

“Can you confirm CBAM applies to this product and share the emissions basis?”

That is the real arrival of CBAM. Not as a policy headline. As a question that can slow a deal, delay a shipment, or quietly shift preference to another supplier.

sentra.world is writing this because we keep seeing the same gap. Many exporters and importers understand the words in the EU CBAM regulation, but struggle when the first real buyer question arrives: What do we reply with, and how fast? This blog is built to help you answer with clarity.

Here is the promise at the start: by the end, you will know what CBAM means in day-to-day trade work, what a buyer is really trying to confirm, and the simplest way to get to a usable answer without building a heavy process upfront.

What is CBAM, really?

If you searched CBAM full form, here it is : Carbon Border Adjustment Mechanism.

CBAM is the EU’s way of putting a carbon cost on certain imported goods so that imports face a similar carbon price to goods produced inside the EU. It starts with reporting in the transition phase, and moves toward certificates and cost impact from 2026. (European Commission)

A quick question that makes this real:

If your EU customer asked, “Will CBAM increase my landed cost for this shipment?”, would you have a confident answer today?

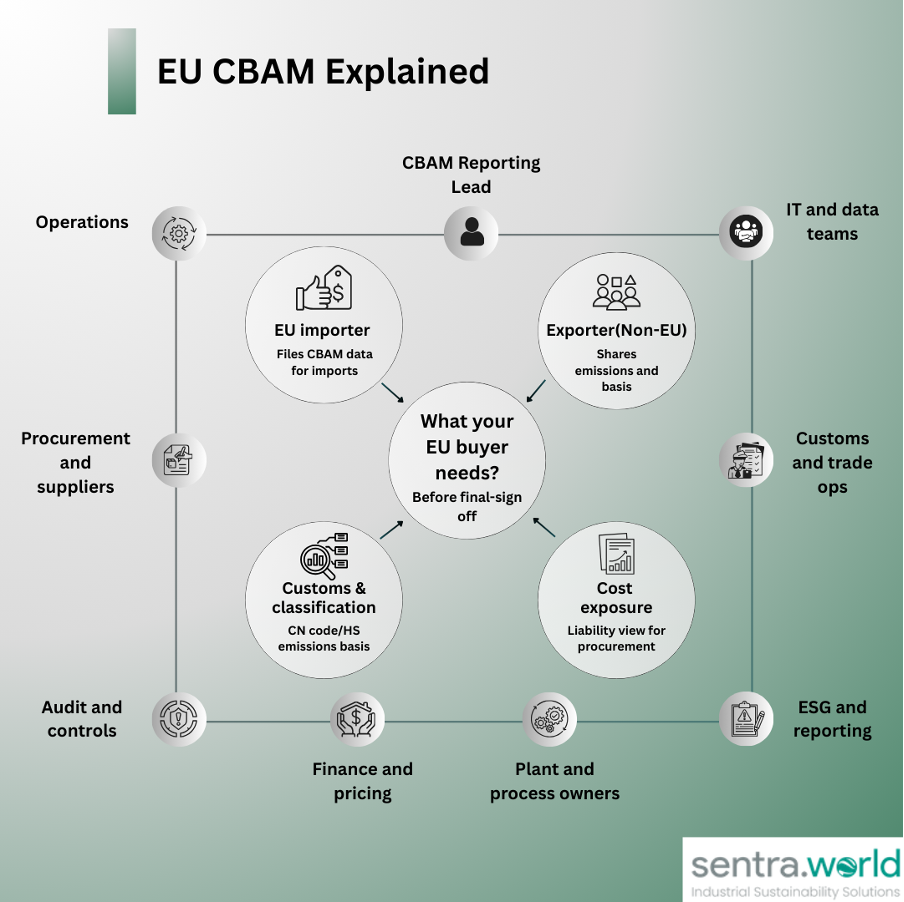

Who is responsible, and why exporters still get pulled in?

On paper, the CBAM reporting obligation sits with the EU importer. In practice, the importer cannot file cleanly without supplier inputs. That is why CBAM for Indian exporters becomes real early.

Buyers do not ask because they are curious. They ask because they are closing reports, managing risk, and trying to avoid expensive surprises.

So, what do they want from you?

Not a lecture. Not a long report.

They want a clean, defensible answer to three things:

- Does CBAM apply to this product?

- If yes, what emissions number should we report, and on what basis?

- What does this mean for cost exposure as CBAM tightens?

Which sectors CBAM cover right now?

CBAM applies to specific carbon-intensive categories, including the ones most exporters worry about first: cement, iron and steel, aluminium, plus fertilisers, hydrogen, and electricity.

The major impact of CBAM is for steel, cement and aluminium sectors, and if your product is in one of these sectors – you are in the direct path of CBAM questions.

A practical question:

Do you have your key products mapped to the right HS or CN codes in one place, or does it depend on who is preparing the paperwork?

The timeline, without confusion

CBAM has two practical phases, and mixing them is where many teams get stuck.

Transition phase (reporting): 01 Oct 2023 to 31 Dec 2025.

This phase created a reporting rhythm that EU buyers are already building into their operations.

Definitive phase (compliance and cost impact): From 01 Jan 2026.

This is when carbon cost discussions stop being theoretical.(European Commission)

Here is the question worth asking now:

If a buyer is preparing for 2026 today, what will they do first: wait for suppliers who respond slowly, or prefer suppliers who can answer quickly?

What buyers actually use your CBAM answer for

Your buyer is not only trying to “stay compliant.” They are also trying to control procurement costs.

Suppliers who provide clean CBAM inputs reduce buyer effort, reduce rechecks, and reduce uncertainty. That becomes a selection lever even before the payment phase fully bites.

So CBAM is not just a regulation. It is a behaviour change in procurement.

The fastest way to respond without building a heavy system

Most exporters waste time in one of two ways:

- debating whether CBAM applies for weeks

- jumping straight into complex calculations without first confirming scope and exposure.

A cleaner approach is two quick checks.

Check 1: Scope check (CN code + covered goods)

Before anything else, confirm whether CBAM applies to the product being shipped.

What you do in this step:

- Map the product to the right HS/CN code

- Check whether that CN code falls under the covered CBAM goods.

- Lock the output as a scope confirmation, your buyer can keep on file.

Why buyers care:

- If the CN mapping is wrong, the rest of the report becomes risky.

- Buyers want a simple “in scope / out of scope” answer they can use immediately.

Where the CBAM Eligibility Checker Checker fits:

- It helps you quickly and consistently apply this first filter, so you don’t waste weeks debating scope.

Check 2: Impact check

Once the scope is confirmed, your buyer’s next worry is not perfection. It is exposure: “What number will I report, and what could it mean for cost later?”

What you do in this step:

- Create a CN-wise emissions view

- Clearly tag what is actual and what is assumed.

- Prepare a simple buyer-ready answer: what drives the number, and what will change when you replace defaults with plant data.

Why buyers care:

- Buyers are already comparing suppliers on how clean the CBAM input is and how quickly they can defend it internally.

- A supplier who gives a usable impact view reduces follow-ups and reduces procurement uncertainty.

Where the CBAM Liability Calculator fits:

- It helps you answer three buyer questions without overbuilding:

- What changes if we use default values vs actual plant data?

- Which missing input increases the result the most?

Closing the loop

Here is the next step:

Confirm whether CBAM applies, then estimate exposure, then improve only what matters most.

That is exactly how CBAM becomes manageable for exporters and importers. And it is how you stay a preferred supplier as EU procurement starts favouring lower uncertainty and lower total cost.

If you want CBAM to stay manageable, the goal is simple: give your EU buyer a response they can use as-is. One file that confirms HS/CN mapping, covers the relevant CN codes, and shows the CN-wise and emissions basis. That is exactly where sentra.world fits, without adding complexity.

- CN scope confirmation: Validate CBAM applicability using correct HS/CN mapping and list the CN codes covered for the shipment.

- CN-wise emissions output: Calculate embedded emissions per CN code using the latest official CBAM methodology.

- Latest values applied: Use the latest published default values and benchmark values wherever actual plant inputs are missing, and keep that clearly tagged.

- Buyer-ready report pack: Provide a clean summary plus Annex IV style detail so procurement and compliance teams can forward it internally without rewriting.

- Audit file readiness: Keep the supporting documents linked to each CN-wise number so proof is retrievable later without rework.

- Registry submission support: Prepare outputs in a format that supports O3CI/registry portal upload when the importer needs it.

- Liability view for cost talks: Use the CBAM Liability Calculator to show what changes under default values vs actual data, and what inputs drive the cost most.

- 2026–2034 planning view: Add a simple year-by-year outlook from 2026 to 2034 to support commercial discussions and budgeting.

This keeps CBAM replies clear, consistent, and easy for your buyer to use.