EU – Carbon Border Adjustment Mechanism

What is CBAM?

The Carbon Border Adjustment Mechanism (CBAM) is an initiative by the European Union to combat climate change by imposing a carbon price on imports from countries with less stringent environmental regulations.

CBAM – related taxes will be substantial and will come soon, so start your decarbonization journey now.

The Carbon Border Adjustment Mechanism (CBAM) is an initiative by the European Union to combat climate change by imposing a carbon price on imports from countries with less stringent environmental regulations.

CBAM - Related Taxes will be Substantial and will Come Soon, So Start your Decarbonization Journey Now.

Cement

Iron & Steel

Aluminum

Fertilisers

Electricity

Hydrogen

Our Key Offerings

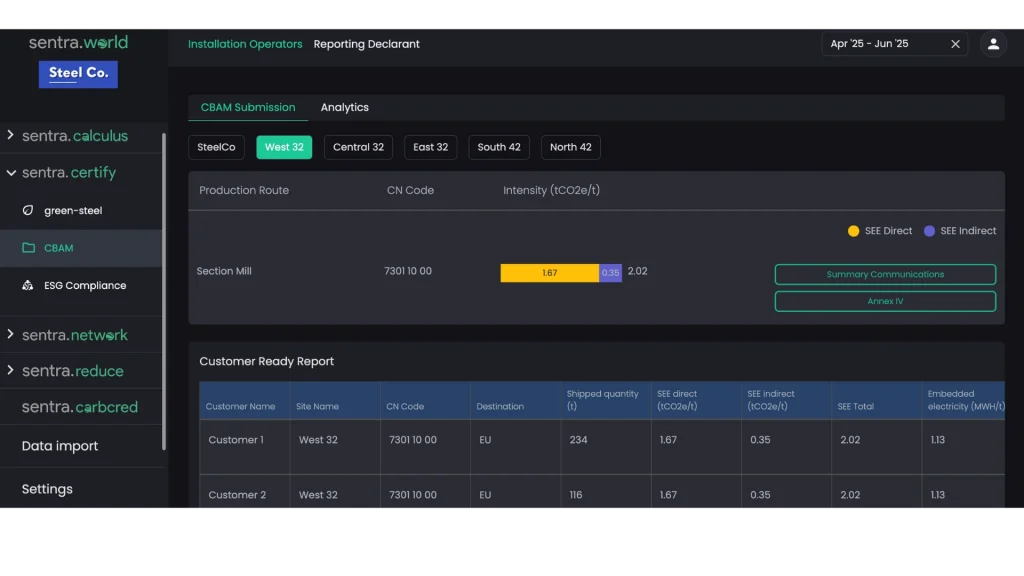

Protect Your Proprietary Emissions Data

Share only the necessary Annex IV and Summary Communications documents to maintain the confidentiality of your operational data.

Start Early Due to Complex Calculations

CBAM involves the most intricate GHG reporting system. Begin preparations early to navigate its complexities effectively.

Prepare for Significant Financial Implications

CBAM-related taxes will be substantial and are coming soon. Initiate your decarbonization efforts now to mitigate these financial impacts.

Our Key Offerings

100% CBAM compliant

Cost efficient

Auditable reports

CBAM expert consulting

Not Sure if CBAM Applies to Your Product?

Just enter your CN Code to check.

EU CBAM Timeline : Are You Prepared?

The EU Carbon Border Adjustment Mechanism (CBAM) is being introduced in stages, starting with the transition phase (2023–2025) focuses on emissions reporting, while the definitive phase from 2026 onwards brings actual CBAM costs and payments for EU-bound exports.

Live Webinar: The CBAM Impact

CBAM becomes mandatory from January 2026 and exports to the EU must be prepared. Join this industry-led speakers discussing the Carbon Border Adjustment Scheme (CBAM) and its real impact on exporters, particularly across steel and carbon-intensive value chain. As CBAM moves from reporting to financial liabilities, exporters face direct carbon tax exposure, audit requirements, and higher costs if emissions data is not calculated and reported correctly.

How Does sentra.world Ensure CBAM Compliance?

Boundary Setting

Define operational boundaries, key drivers, and process inclusion to establish a clear framework for CBAM compliance.

Data Collection

1. Implement data mapping and ERP integration for seamless information flow.

2. Utilize AI-led data validation to ensure accuracy.

3. Collect, validate, and integrate supplier data efficiently.

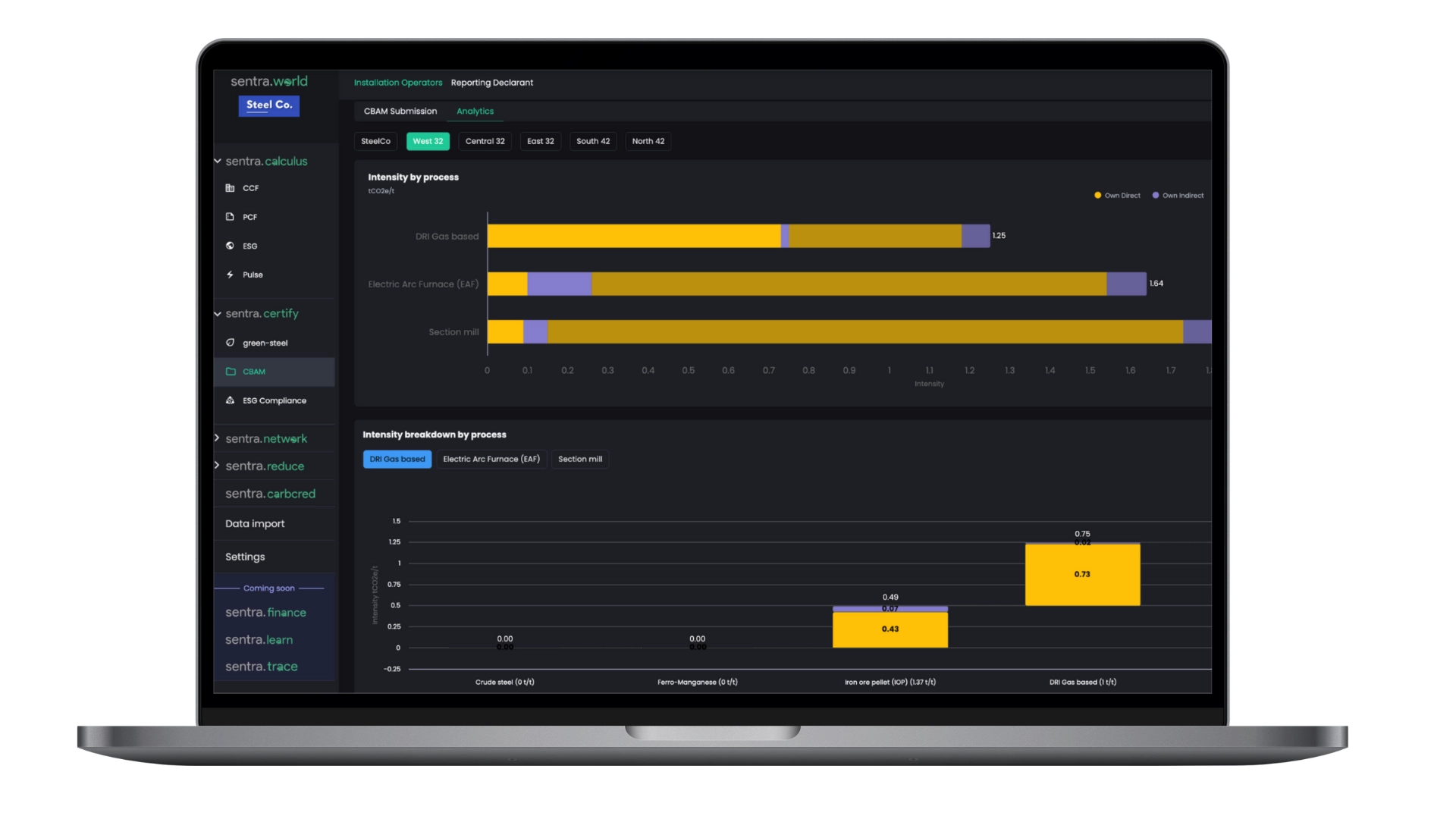

Calculations

1. Follow approved CBAM methodologies and default emission factors.

2. Perform detailed carbon balance calculations at the process level for precise emission reporting.

Report Preparations

1. Automate the creation of summary reports (Summary Comm, Annexure IV) for customers.

2. Provide in-depth calculation files as backup documentation.

Customer Alignment

Ensure 100% acceptance from customers and compliance with EU regulations.

How Does sentra.world Ensure CBAM Compliance?

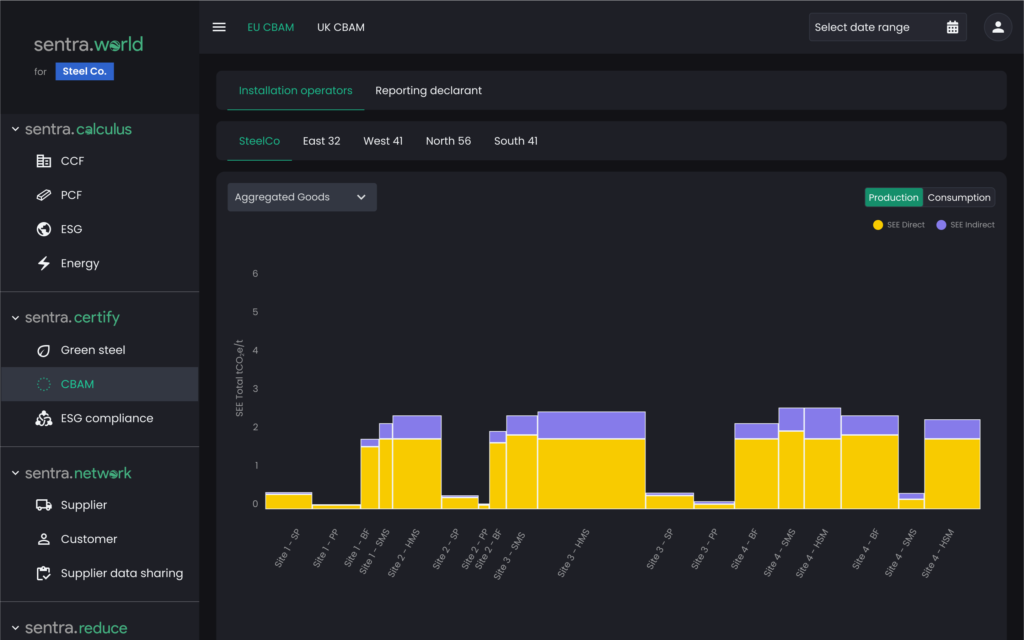

sentra.world provides a suite of digital tools to help companies comply with CBAM regulations.

Comprehensive emissions calculation per CN code

- Quarterly detailed report with analytics on platform

- Covering all applicable CN codes

- Following the latest and official CBAM methodology

- Using latest default and benchmark values from CBAM

Official document & audit preparation as per EU regulations

- Summary communication & Annexure IV

- Support for O3CI portal upload

- Document preparation for 3rd party audit

Carbon tax and certificates related support

- Estimation of carbon tax as per EU ETS carbon price

- Year on year forecast from 2026 till 2034

- Guidance on commercial discussions with customers

Frequently Asked Questions

CBAM is a carbon pricing system introduced by the EU to impose fees on carbon-intensive goods imported into the EU, aiming to level the playing field between EU-produced and imported goods by accounting for carbon emissions.

CBAM aims to prevent carbon leakage, where companies relocate production to countries with less stringent climate policies. It promotes equal competition and encourages global adoption of carbon pricing to reduce greenhouse gas emissions.

CBAM impacts EU importers of covered goods (iron, steel, aluminium, cement, electricity, fertilisers), non-EU producers exporting to the EU, and EU companies using these imports. Costs and reporting requirements will vary based on their role in the supply chain.

While the ETS sets caps on greenhouse gas emissions for EU companies, CBAM imposes a carbon price on imports to ensure that imported goods face similar costs. This helps prevent competitive disadvantages for EU manufacturers adhering to stringent environmental standards.

Initially, CBAM covers imports of iron, steel, aluminium, electricity, certain fertilisers, and cement. The scope may expand to include plastics, chemicals, and all sectors covered by the EU ETS by 2030.

To calculate CBAM emissions, follow these steps:

1. Determine which imported goods are covered under CBAM (e.g., steel, cement, aluminium, fertilizers, hydrogen, electricity).

2. Use primary data from suppliers for the most accurate emissions reporting. If primary data is unavailable, use default emission factors provided by the European Commission or regional factors.

3. Calculate emissions using the formula: Emissions = Weight of goods (tonnes) × Emission factor (emissions per tonne). During the transitional period, default values can be used until July 2024.

sentra.world simplifies this process with advanced tools that ensure accurate, compliant, and efficient CBAM reporting.

CBAM’s transitional phase began in October 2023 with reporting requirements. Full implementation, including payment obligations, will start in January 2026, aligning with the phase-out of free ETS allowances for EU producers.

CBAM will affect trade dynamics by imposing carbon costs on imports, potentially leading to new trade agreements and increased adoption of carbon pricing globally. It aims to reduce carbon emissions through Scope 1, Scope 2 and Scope 3, and encourage greener supply chains.

Latest Blogs

A buyer in the EU is reviewing your next shipment. The discussion is going well. Price is fine. Lead time is fine. Then

CBAM Compliance is not coming as a shock announcement. It is already showing up in day-to-day trade work. EU buyers are starting to

What’s New at a Glance? The European Union has recently confirmed that Carbon Border Adjustment Mechanism (CBAM) benchmarks for exporters in other countries