India’s Carbon Credit Trading Scheme (CCTS)

An integrated solution for CCTS calculation, verification, submission and carbon credits.

What is CCTS in India?

Carbon Credit Trading Scheme (CCTS) is India’s national carbon market, launched under the Energy Conservation (Amendment) Act, 2022. It lets companies earn or buy Carbon Credit Certificates (CCCs) based on their emissions performance.

It is managed by the Ministry of Power (MoP) and administered by the Bureau of Energy Efficiency (BEE).

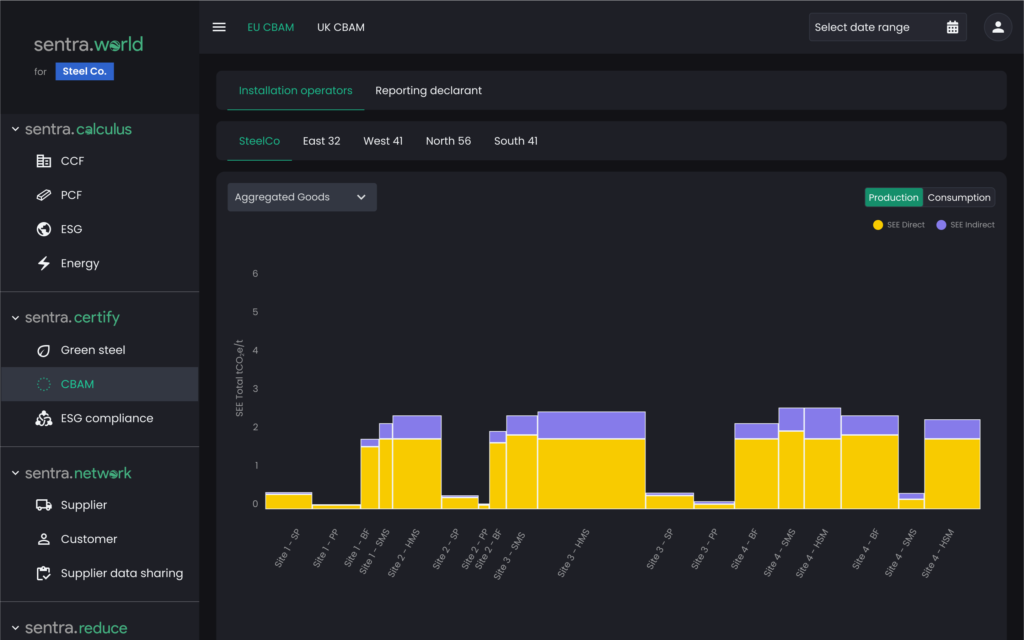

The Carbon Border Adjustment Mechanism (CBAM) is an initiative by the European Union to combat climate change by imposing a carbon price on imports from countries with less stringent environmental regulations.

CBAM - Related Taxes will be Substantial and will Come Soon, So Start your Decarbonization Journey Now.

Cement

Iron & Steel

Aluminum

Fertilisers

Electricity

Hydrogen

Our Key Offerings

Protect Your Proprietary Emissions Data

Share only the necessary Annex IV and Summary Communications documents to maintain the confidentiality of your operational data.

Start Early Due to Complex Calculations

CBAM involves the most intricate GHG reporting system. Begin preparations early to navigate its complexities effectively.

Prepare for Significant Financial Implications

CBAM-related taxes will be substantial and are coming soon. Initiate your decarbonization efforts now to mitigate these financial impacts.

Our Key Offerings

5-Star Green Steel

< 1.6 tCO₂e/tfs (Best-in-class, highly sustainable)

4-Star Green Steel

1.6 – 2.0 tCO₂e/tfs

3-Star Green Steel

2.0 – 2.2 tCO₂e/tfs

No Rating

> 2.2 tCO₂e/tfs (Does not qualify as green steel)

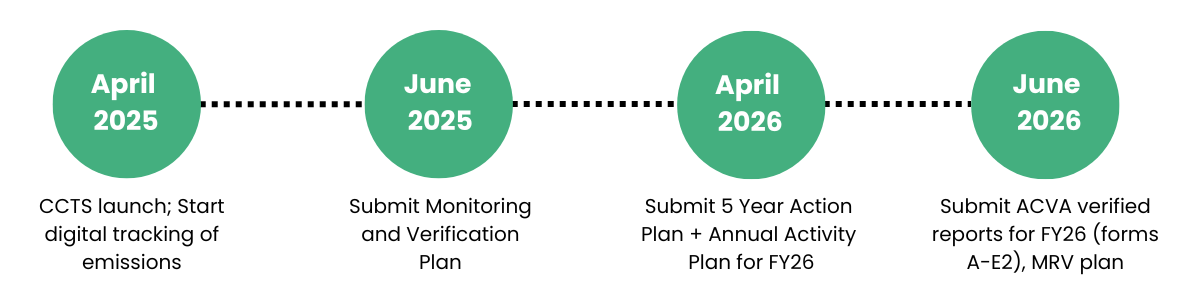

461 companies have been notified by BEE as obligated entities – if you’re on the list, it’s time to prepare now.

CCTS is Here, Are You Ready?

The process for India’s new Carbon Credit Trading Scheme (CCTS) is already underway. Here’s the timeline, process, and compliance requirements to stay ahead.

How Does sentra.world Ensure CBAM Compliance?

Boundary Setting

Define operational boundaries, key drivers, and process inclusion to establish a clear framework for CBAM compliance.

Data Collection

1. Implement data mapping and ERP integration for seamless information flow.

2. Utilize AI-led data validation to ensure accuracy.

3. Collect, validate, and integrate supplier data efficiently.

Calculations

1. Follow approved CBAM methodologies and default emission factors.

2. Perform detailed carbon balance calculations at the process level for precise emission reporting.

Report Preparations

1. Automate the creation of summary reports (Summary Comm, Annexure IV) for customers.

2. Provide in-depth calculation files as backup documentation.

Customer Alignment

Ensure 100% acceptance from customers and compliance with EU regulations.

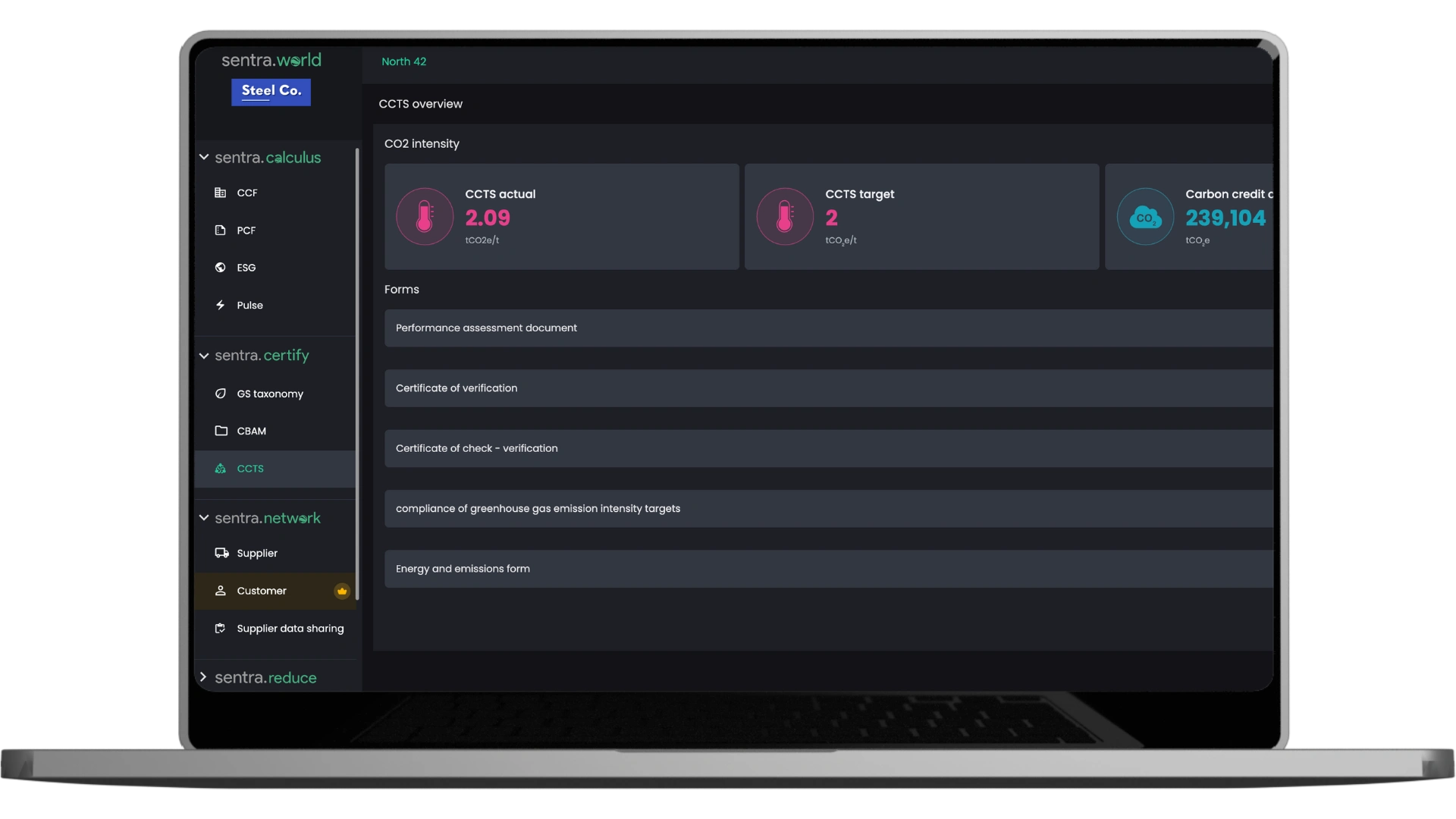

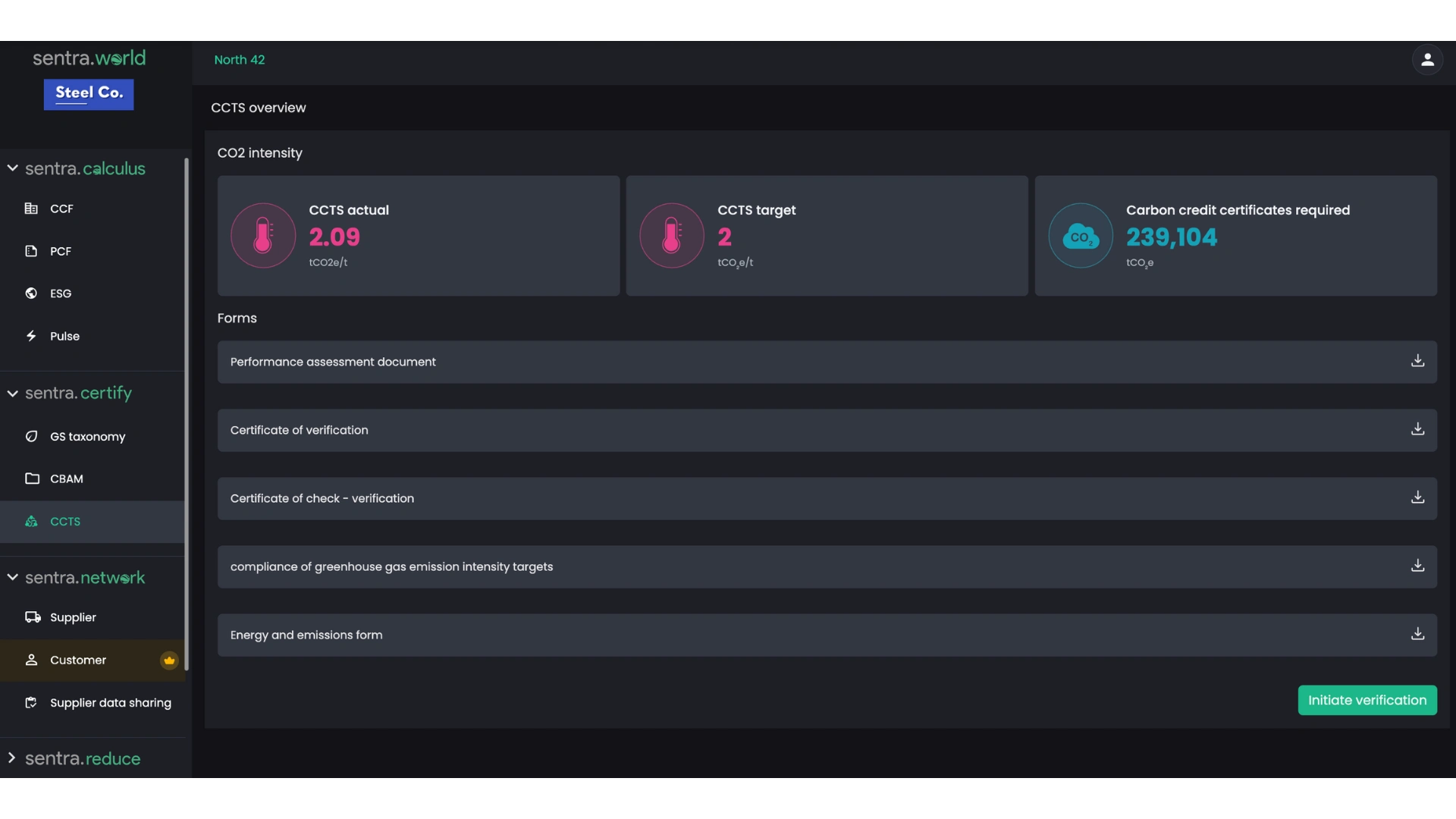

How does sentra.world help with CCTS?

CO₂ emissions calculation as per CCTS methodology

Digital platform to track emissions on a monthly basis

Action plan to meet CCTS reduction targets

Documentation for submission

3rd party verification

Frequently Asked Questions

CCTS stands for Carbon Credit Trading Scheme, India’s new carbon market that allows

companies to trade Carbon Credit Certificates (CCCs) based on their emissions.

Under the Carbon Credit Trading Scheme (CCTS), 461 obligated entities across nine sectors -steel, cement, aluminum, refineries, fertilizers, textiles, pulp & paper, petrochemicals, and chloralkali, must comply.

PAT promotes energy efficiency, while CCTS India focuses on carbon emissions, enabling companies to buy and sell carbon credits through a market-driven mechanism.

The price of 1 ton of carbon credit in India under CCTS will be market-driven and

determined once trading begins in the Indian carbon market. The price is highly variable ranging from ₹600-900 per ton.

Under CCTS India, companies receive emission targets; those below limits earn tradable CCCs, while those exceeding must buy credits, verified by Accredited Carbon Verifiers (ACVAs).

The Carbon Credit Trading Scheme (CCTS) aims to reduce emissions, drive decarbonisation, and integrate India into the global carbon credit market.

461 companies across nine energy-intensive sectors notified by the BEE must comply with carbon credit trading scheme (CCTS).

Yes. Under the Carbon Credit Trading Scheme, verification by an Accredited Carbon Verifier and Auditor (ACVA)is mandatory before issuing or surrendering CCCs.

The Ministry of Power oversees CCTS, with the BEE managing operations and the NSC-ICM

providing regulatory oversight.

Latest Blogs

As India plans to reach its 2070 net-zero goal; there are many policies which are coming up evolving from energy efficiency to carbon

India’s Carbon Credit Trading Scheme (CCTS) introduced by the BEE (Bureau of Energy Efficiency) marks a foundational step in India’s decarbonisation journey. Under

Over the past six months, the world has witnessed a rapid expansion of carbon markets. Countries such as India, Saudi Arabia, Pakistan, UAE,