The European Union’s Carbon Border Adjustment Mechanism (CBAM) continues to evolve as the EU works to reduce carbon leakage by ensuring that high-carbon products imported from outside the EU face a carbon price similar to that of EU-produced goods. With the Omnibus package introduced by the European Commission, the process of complying with CBAM has been significantly simplified, particularly for small and medium-sized enterprises (SMEs) and exporters of CBAM goods. This blog post breaks down the latest CBAM updates in the Omnibus package and what exporters need to know in 2025, especially from non-EU countries like India, can adapt to these changes.

1. Minimum Import Threshold: Who Needs to Report?

One of the most notable changes in the Omnibus package is the introduction of a de minimis threshold for CBAM compliance. Importers who bring in fewer than 50 metric tons (mt) of CBAM goods per year are now exempt from reporting embedded emissions and purchasing CBAM certificates. This new threshold is crucial for SMEs in particular, as it significantly reduces the administrative and financial burden associated with CBAM compliance.

Impact on Exporters (Operators of installations)

Exporters, particularly those from India, need to be proactive in understanding whether their customers fall below or above the 50 mt threshold. While an exporter may only send 30 mt of goods to an EU-based importer, that importer might purchase additional goods from other suppliers, putting them above the threshold. In such cases, the importer would still need to comply with CBAM obligations and report the embedded emissions.

It is essential for exporters to communicate with their EU customers and confirm their total annual imports of CBAM goods. If the customer is importing more than 50 mt annually, the exporter will need to provide the necessary emissions data for compliance. However, if the customer’s total imports are below the threshold, then the reporting obligation falls off the table, offering some relief for exporters.

2. CBAM Representative: Simplifying Compliance through Third-Party Delegation

Another important update in the Omnibus package is the introduction of the ability for reporting declarants (importers) to appoint a CBAM representative. These representatives, who can be third-party consultants or environmental experts, are authorized to submit CBAM declarations on behalf of the importers. This delegation helps importers who lack the technical expertise or capacity to handle the complex calculations and reporting required under CBAM.

Impact on Exporters (Operators of installations)

From an exporter’s perspective, the introduction of a CBAM representative does not directly change how embedded emissions need to be calculated and reported. However, it the responsibility for managing CBAM compliance lies solely will the reporting declarant. Exporters should remain in close communication with their customers to ensure that all necessary emissions data is passed on accurately to the CBAM representative for proper declaration.

3. Flexibility in Emissions Reporting: Default Values vs. Actual Emissions

In the past, CBAM required reporting declarants to calculate their actual emissions or use default emission values with a maximum allowed margin of error. The Omnibus package has introduced more flexibility by allowing declarants to choose between using actual emissions data or default values, with the latter including a mark-up.

For declarants, this change provides an opportunity to reduce the complexity of emissions reporting. Instead of having to gather detailed emissions data from each supplier, exporters can use default values, which are proposed to be calculated based on the top 10 highest-emission intensity countries for a particular product. However, this flexibility comes with the risk of higher costs if the default values along with the proposed markup are less favourable than actual emissions data.

Impact on Exporters (Operators of installations)

While the exact mark-up for default values is still being defined, it’s important for exporters to work closely with their customers and setup adequate emission monitoring and verification processes in order to ensure actual emissions data are used by the importers. If an exporter’s goods are sourced from regions with lower emissions, it may be more cost-effective to provide actual emissions data rather than relying on potentially inflated default values.

4. Challenges with Data Collection: Handling GHG Reused in Processes

Collecting accurate data on emissions, particularly from processes like waste gases and reused greenhouse gases (GHG), remains a significant challenge. For these specific emissions, the Omnibus package specifies that emission factors from the World Steel Association (WSA) or the International Energy Agency (IEA) should be used. This ensures consistency in reporting and helps exporters and importers align their calculations.

Impact on Exporters (Operators of installations)

Exporters should be aware of the data collection requirements related to waste gases and reused GHGs in their manufacturing processes. In order to ensure error-free calculations, exporters are better off leveraging technology enabled solutions which will minimize need for manual work.

5. Clarifying Emission Calculations for Downstream Operations

The Omnibus package clarifies that emissions from downstream operations—processes that occur after the primary manufacturing stage—will not be included in CBAM’s embedded emissions calculations. These processes, such as finishing or assembly, often rely on precursors and materials that already carry embedded emissions, and CBAM will focus on reporting those emissions rather than the secondary operations.

Impact on Exporters (Operators of installations)

Exporters involved in industries with downstream processing (e.g., steel or aluminum) will now have clearer guidelines on which emissions need to be reported. If the downstream processes are excluded from CBAM’s scope, exporters should work with their customers to ensure they only report the emissions related to the primary production processes and precursors used.

The final list of processes that will be classified as downstream for individual industries will be released in a subsequent regulation

“To reduce the burden on operators in third countries from the additional monitoring of emissions of the final production steps – the latter typically not covered by EU ETS – it is proposed to exclude those manufacturing processes from the boundaries of the calculation of emissions for these aluminium and steel goods”

6. No need to report embedded emissions for precursors purchased from EU

If a precursor used in the production was produced in the EU, the embedded emissions associated with the same can be excluded from emissions reporting since the producer of those precursors has already paid the associated carbon tax under EU ETS

7. No need to get verification done for embedded emissions if default values are used

Verification of embedded emissions calculated using default values published by Commission are proposed to be obviated to ease compliance burden since there is no value added by verification of default values

8. Changes in CBAM Declaration Timeline

The Omnibus package introduces changes to the CBAM declaration deadline. The submission date for annual CBAM declarations has been extended from May 31 to August 31, with corresponding changes to the certificate repurchase and cancellation dates. This shift aligns CBAM reporting with the EU Emissions Trading System (ETS) deadlines and allows businesses more time to compile accurate data.

Impact on Exporters (Operators of installations)

For exporters, this extended timeline provides additional flexibility in ensuring compliance. Exporters can now expect their customers to have more time to gather data and submit their CBAM declarations, allowing for smoother communication and fewer last-minute rushes to meet the deadlines.

9. Changes in CBAM Financial Liability

The Omnibus package also includes provisions to reduce the financial burden on importers by lowering the required amount of CBAM certificates to be held by 50% (from 80%). This change is expected to improve liquidity and reduce the capital lock-up for importers who have to buy CBAM certificates to cover their embedded emissions.

Impact on Exporters (Operators of installations)

Exporters should keep an eye on how these financial adjustments affect their customers’ ability to manage CBAM costs. While there is no direct impact of these changes on the exporters, it is important to stay updated with the financial obligations in order to ensure effective business relationship.

10. Taxation and Third-Country Carbon Taxes

Although CBAM’s carbon tax implications will officially begin in 2026, payments for goods imported in that year will only start in February 2027. Additionally, the payment of carbon taxes in third countries will need to be evidenced by importers to avoid double taxation.

Impact on Exporters (Operators of installations)

Exporters need to stay updated on their customers’ carbon tax payments in third countries, ensuring that these payments are properly documented and reported. This will be essential for reducing the overall cost burden for their customers and avoiding double taxation.

11. Use of default values for carbon prices paid in the third-party country

To eliminate funds being locked up in excess CBAM certificate purchases, it has been proposed to give declarants the option to use default carbon price paid (EUR / tCO2e) in the exporting country at the time of submitting their embedded emissions to eliminate the need to purchase excess CBAM certificates

Conclusion: Stay Ahead of CBAM Compliance with sentra.world

As the CBAM framework evolves with the latest latest CBAM update, staying compliant can be challenging for exporters. From understanding new reporting thresholds to navigating emissions calculations and financial obligations, businesses need a streamlined, tech-driven approach to CBAM compliance.

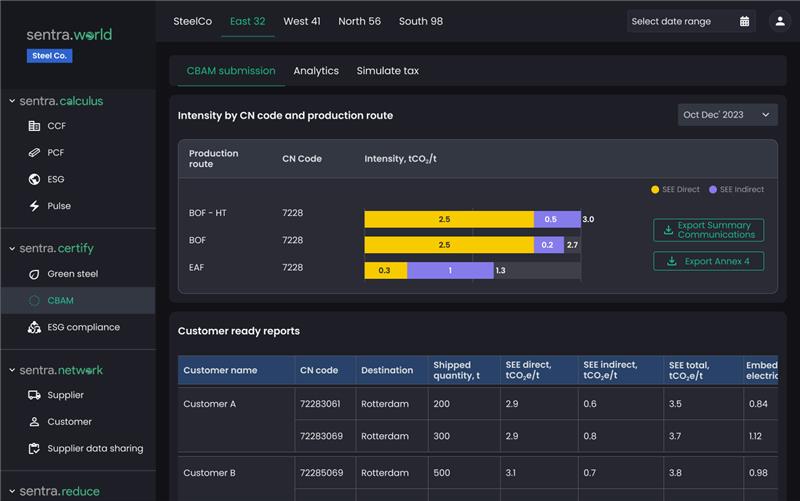

sentra.world simplifies this process by offering automated CBAM reporting, real-time emissions tracking, and compliance management solutions. Our platform helps exporters:

- Accurately calculate embedded emissions for CBAM declarations.

- Seamlessly integrate actual emissions data or default values for cost optimization.

- Ensure regulatory compliance with automated reporting and CBAM certificate tracking.

- Managing certificate purchases and cancellations

Stay Updated & Get in Touch!

CBAM regulations are continuously evolving—sentra.world keeps you ahead of the curve with the latest CBAM updates, expert insights, and cutting-edge compliance solutions. Visit sentra.world to learn more or connect with us for personalized guidance and the latest CBAM update.

Contact us contact_us@sentra.world

Let’s make sustainability compliance effortless!